Aspiring for the JAIIB certification? Retail Banking & Wealth Management (RBWM) is one of the papers that you must qualify to move one step ahead to qualify for the JAIIB exam. But how to prepare for the JAIIB RBWM paper? This article is your answer.

In this article, we’ll explain the best JAIIB RBWM preparation strategy in 7 easy steps to help you qualify the paper in your first attempt. It includes PYQ analysis, important topics, module prioritization, how to cover each module, and a practical timetable sample that you can customize according to your strengths, weaknesses, and available time.

Step 1: Streamline the Syllabus

Before streamlining the syllabus, it is important to understand the complete syllabus of the RBWM paper. RBWM consists of four modules:

- Module A: Retail Banking

- Module B: Retail Products and Recovery

- Module C: Support Services – Marketing of Banking Services/Products

- Module D: Wealth Management

Read the article “JAIIB Exam Syllabus” to understand the syllabus in detail.

Navigating the extensive JAIIB RBWM syllabus may seem daunting, but remember, the exam is about qualification, not perfection. Streamlining the syllabus is essential as the RBWM paper is qualifying in nature and you need a strategy to score qualifying (50+) marks. Streamlining the syllabus allows you to identify high-scoring topics. This smart approach saves your precious time by preventing you from feeling overwhelmed by the vastness of the exam syllabus.

Now that you have streamlined the syllabus, it is time to analyze the PYQs to understand the difficulty level, RBWM trends, weightage, and question types.

Step 2: Understand the PYQ Analysis

PYQ analysis reveals which topics appear regularly in the paper, their weightage, and question types, allowing you to prioritize your study efforts and focus on areas with high weightage.

To make it easy for you, we have analyzed the RBWM May and October 2023 papers to identify the key takeaways. Read below:

1. Difficulty Level

The JAIIB RBWM October 2023 paper presented a difficulty level of moderate to difficult and was notably lengthy, requiring candidates to manage their time efficiently during the paper.

2. RBWM Trends

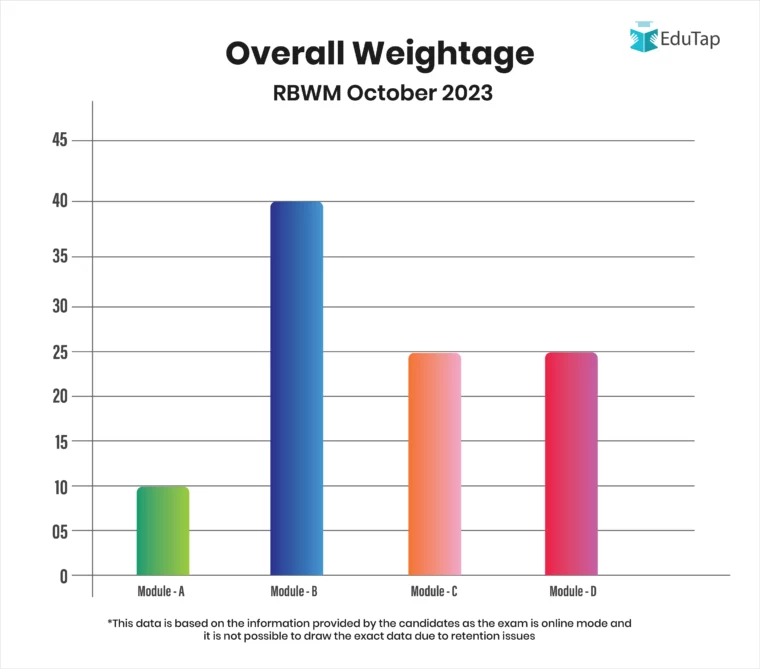

The majority of questions were derived from Module B, followed by Modules C and D, while Module A had the least number of questions. Hence, you should prioritize your study efforts by starting with Module B to build a strong foundation in the areas with higher question frequency.

3. Overall Weightage

Module A consisted of approximately 10 questions, Module B had the highest, around 40, and Modules C and D contained about 20 to 25 questions each. Therefore, it is highly advisable to start your preparation from Module B.

4. Question Types

Questions were asked about important topics such as mutual funds, investment banking, wealth managers, PMAY, risk management, ATMS, etc. So, you should cover the important topics from each module to qualify for the RBWM paper. Important topics are mentioned below in the article.

Here is a detailed video explaining the JAIIB RBWM October 2023 paper analysis.

RBWM 2023 PYQ analysis also helps you identify the important topics that you must cover to enhance your preparation for the paper.

Step 3: Identify Important Topics

Analyzing the PYQs allows you to understand past trends and identify the most important topics. To make it easy for you, we have analyzed the RBWM May and October 2023 papers to identify the most important topics. Read below:

1. Module A

| Module A: Retail Banking | ||

| SNo. | Chapters | Topics |

| 1 | Retail Banking: Introduction | Characteristics, advantages, and constraints in Retail Banking |

| 2 | Retail Banking: Role within the Bank Operations | Business Models |

| 3 | Applicability of Retail Banking Concepts and Distinction between Retail and Corporate/Wholesale Banking | Distinction between Retail and Corporate/ Wholesale Banking |

| 4 | Branch Profitability | Categories of Profit, Return on Asset, Return on Equity, Branch Operating Efficiency, Factors affecting profitability |

2. Module B

| Module B: Retail Products and Recovery | ||

| SNo. | Chapters | Topics |

| 1 | Customer Requirements | Maslow’s Theory |

| 2 | Product Development Process | Product Life Cycle, Debit or Credit Products, Third Party Products, Product Management |

| 3 | Credit Scoring | Credit Scoring Model, Credit Information Companies in India, Issues in Credit Scoring |

| 4 | Important Retail Liability Products | Types of deposits |

| 5 | Important Retail Asset products | PMAY, Types of Loans |

| 6 | Credit and Debit Cards | Co-Branded Cards |

| 7 | Remittance Products | NEFT, RTGS, ECS, NACH, BBPS, AePS |

| 8 | Digitisation of Retail banking Products | IDRBT, INFINET, SFMS, ISCC, NFS |

| 9 | Role of AI and Technology in Retail Banking Products | Benefits of AI in Retail Banking |

| 10 | Recovery of Retail Loans | SARFAESIAct, DRT, Lok Adalat |

| 11 | Management Information Systems | Role of MIS in Banking Industry |

| 12 | Securitization | Securitization of Assets |

3. Module C

| Module C: Support Services – Marketing of Banking Services/Products | ||

| SNo. | Chapters | Topics |

| 1 | Marketing: An Introduction | Marketing Mix |

| 2 | Delivery Channels in Retail Banking | Channel Experience, Internet Banking |

| 3 | Delivery Models | Direct Selling Agents, Dedicated Marketing Managers |

| 4 | Customer Relationship Management in Retail Banking | Implementation of Process of CRM, Benefits of CRM |

| 5 | Service Standards for Retail Banking | BCSBI Customer Grievance Handling |

| 6 | Marketing Information System: A Longitudinal Analysis | Functions of MKIS |

4. Module D

| Module D: Wealth Management | ||

| SNo. | Chapters | Topics |

| 1 | Importance of Wealth Management | Instruments of Wealth Management |

| 2 | Investment Management | Portfolio Management |

| 3 | Tax Planning | All Topics |

| 4 | Other Financial Services Provided by Banks | All Topics |

After understanding the important topics, it’s time to start your preparation by prioritizing modules.

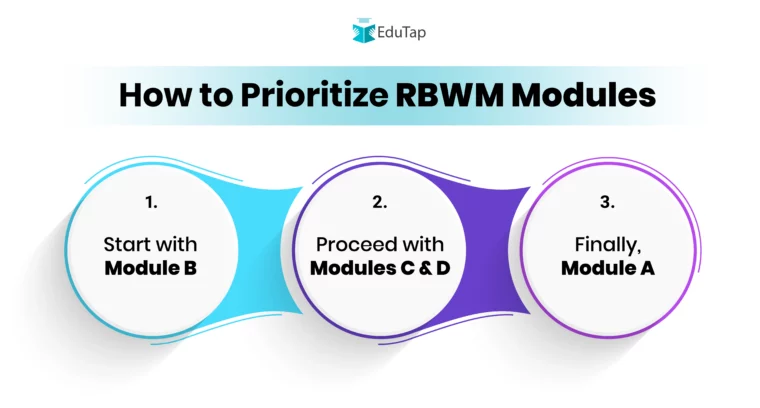

Step 4: Prioritize Modules

By prioritizing modules, you’ll allocate your precious time accordingly, focusing on high-value topics that increase your chances of qualifying the paper. But where to begin?

Below, we have explained the sequence in which you should start your preparation.

1. Start with Module B

Initiate your JAIIB RBWM preparation by prioritizing Module B, as the majority of questions (around 40) were asked in the 2023 papers from this module. This enables you to tackle the most scoring topics first, allowing you to build a strong foundation and boost your confidence.

2. Proceed with Modules C and D

After successfully covering Module B, the next strategic step is to cover Modules C and D. This sequential approach ensures a comprehensive understanding of key concepts and topics, allowing you to progress logically through the syllabus.

3. Finally, Module A

Module A, with only 10 questions asked in the October 2023 paper, is considered the lowest-scoring module. Therefore, it’s advisable to keep Module A for the last phase of your JAIIB RBWM preparation.

After prioritizing your modules, it’s time to start preparing according to the suggested preferences.

Step 5: Understand How to Cover Each Module

Below, we have mentioned the strategy to help you understand how to cover each module:

1. Cover Important Topics

As mentioned in the article above, you should start your preparation by covering the important topics from each module. You can divide the topics into manageable chunks and allocate time accordingly. Moreover, you must set realistic deadlines for completing each module.

2. Practice Consistently with Mock Tests and PYQs

After completing the important topics from each module, you should start practicing PYQs and mock tests. It allows you to assess your understanding, identify areas for improvement, and practice time management. You must analyze your performance to pinpoint strengths and weaknesses, guiding further study efforts. Tailor your study plan accordingly, emphasizing areas that need improvement while maintaining proficiency in strong subjects.

3. Don’t Forget to Revise

Don’t underestimate the impact of revisiting key concepts and important topics. Regular and strategic revision not only reinforces your understanding but also helps in retaining information in the long run.

Now that you have understood how to cover each module, let’s understand the best books and resources to help you prepare for the RBWM paper.

Step 6: Identify Important Books and Resources

Here are the best books and sources to prepare for the RBWM paper:

| Best Books and Sources for RBWM Preparation | ||||

| SNo. | Books | Author | Publisher | Buy Here |

| 1 | Retail Banking & Wealth Management | IIBF | Macmillan | Buy Online |

Other Recommended Sources

Below are the other recommended sources that can help you further enhance your preparation.

1. Retail Banking PDF by BAOU

The Retail Banking PDF from Dr Babasaheb Ambedkar Open University (BAOU) is a crucial resource for RBWM paper preparation, as direct questions are sourced from it.

2. IIBF e-Learning Portal

IIBF offers an e-learning portal where you can access digital study material, online courses, and mock tests to prepare for the RBWM paper. This is an excellent resource to enhance your understanding of the exam topics.

3. Online Learning Platforms

There are multiple online learning platforms that offer RBWM courses. These platforms offer a wide range of study materials, interactive lessons, practice quizzes, mock tests, and guidance from experienced educators.

4. YouTube Videos

EduTap JAIIB YouTube channel provides free insightful tutorials and explanations on important RBWM topics, allowing you to understand complex RBWM topics through quality video lectures.

After getting familiar with the important books and resources, let’s understand the timetable for the JAIIB RBWM preparation.

Step 7: Make a Practical Timetable

To prepare well for the RBWM paper, it is essential to create and follow a practical timetable. Here’s a module-wise sample timetable that you can customize according to your strengths, weaknesses, and the available time you have:

| Retail Banking and Wealth Management | |||

| SNo. | Module | Time | Instructions |

| 1 | Module A: Retail Banking | 4 Hours |

|

| 2 | Module B: Retail Products and Recovery | 8 Hours |

|

| 3 | Module C: Support Services – Marketing of Banking Services/Products | 5 Hours |

|

| 4 | Module D: Wealth Management | 10 Hours |

|

| Total | 22 Hours | ||

General Tips:

- Adjust the above timetable to suit your specific needs.

- Take short breaks (5-10 minutes) between sessions.

- Structure your study schedule to align with your daily routine. For working professionals, consider dedicating extended study periods on weekends to optimize exam preparation.

Conclusion

You should start your JAIIB RBWM preparation by streamlining the vast syllabus and analyzing PYQs. It helps you identify the important topics, allowing you to strategically focus on high-scoring areas. The next step is to cover the important topics from each module, starting from Module B, then C and D, leaving A for last. Practice mocks to identify strengths and weaknesses for a well-rounded preparation to qualify for the JAIIB RBWM paper.

FAQs

The difficulty level varies for individuals, but with strategic preparation, you can qualify for the JAIIB RBWM paper.

While comprehensive coverage is ideal, prioritizing high-scoring topics is strategic. Remember JAIIB RBWM is qualifying in nature.

While textbooks are valuable, combining them with other offline and online resources offers a more comprehensive approach.

Practicing mock tests is crucial for familiarizing yourself with the exam format, question types, and time management. It also helps you identify your strengths and weaknesses, allowing you to work on areas that need improvement. Regularly practicing mock tests enhances your speed, accuracy, and confidence, ensuring you are well-prepared for the actual RBWM paper.