Are you feeling overwhelmed by the vast Indian Economy and Indian Financial System (IE&IFS) syllabus? Are you unsure about where to initiate your IE&IFS preparation? This article is your roadmap to success.

In this article, we’ll explain the 7 steps of the IE&IFS preparation strategy. It presents important topics, which module to start first, important books and resources, and a practical timetable that you can tailor according to your needs. So, whether you’re an experienced aspirant or a passionate newcomer, this preparation strategy offers a clear path to qualify the IE&IFS paper for JAIIB 2024.

Step 1: Streamline the Syllabus

Before streamlining the syllabus, it is important to understand the complete syllabus of the IE&IFS paper. IE&IFS consists of four modules:

- Module A: Indian Economic Architecture

- Module B: Economic Concepts Related To Banking

- Module C: Indian Financial Architecture

- Module D: Financial Products And Services

Read the article “JAIIB Exam Syllabus” to understand the syllabus in detail.

After understanding the JAIIB IE&IFS syllabus, you must streamline the syllabus as you are not required to score 100% marks. JAIIB is qualifying in nature, and you just need to score 50+ marks to qualify the exam. Having a streamlined syllabus allows you to identify the key concepts and areas of focus more clearly, preventing you from feeling overwhelmed by the vastness of the exam syllabus. This allows you to concentrate your studies on the most important topics, maximizing your time and effort.

Now that you have streamlined the syllabus, it is time to analyze the PYQs to understand the difficulty level, IE&IFS trends, weightage, and question types.

Step 2: Understand the PYQ Analysis

PYQ analysis reveals which topics appear regularly in the paper, their weightage, and question types, allowing you to prioritize your study efforts and focus on areas with high weightage.

To make it easy for you, we have analyzed the IE & IFS May and October 2023 papers to identify the key takeaways. Read below:

1. Difficulty Level

The difficulty level of the JAIIB IE & IFS paper of October 2023 was between moderate to difficult. Additionally, the exam was lengthy. This combination required candidates to demonstrate a comprehensive understanding of the IE & IFS paper and effective time management skills to attempt the exam successfully.

2. IE & IFS Trends

In the JAIIB IE & IFS October 2023 paper, most questions were derived from the “Indian Economy & Indian Financial System” book. Consequently, this book emerges as a key and primary resource for effective exam preparation.

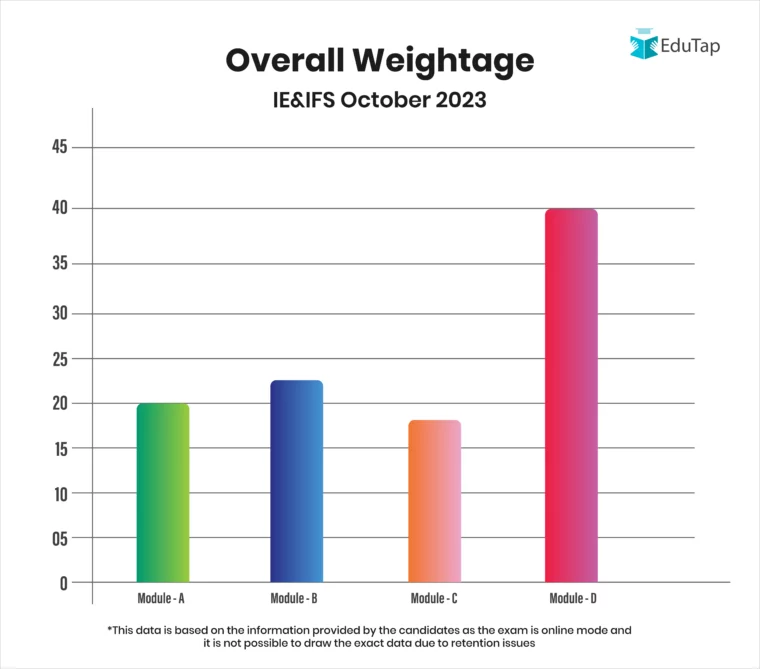

3. Overall Weightage

In the JAIIB IE & IFS October 2023 paper, the maximum number of questions were asked from Module D (around 40 questions). Hence, starting your preparation from Module D is recommended, considering its significance to the distribution of questions in the paper.

4. Question Types

The questions featured in the JAIIB October 2023 paper primarily revolved around fundamental concepts, encompassing basic definitions, types, norms, and regulations. There were questions from repeated topics such as PMJJBY, MCLR, MFI Categories, GDP, Tri-Party Repo, and Primary Deficit. These questions contribute to 3/4th of the qualifying marks, so if you had reviewed the May paper, you could confidently qualify the paper.

In contrast, some topics featured in the JAIIB IE & IFS May 2023 paper had no representation in the October paper. These included Fair Globalization, WTO Functions, and the Committee on Universal Banks. Additionally, unexpected topics like NAV Roundoff and Numerical on CSR posed challenges in the exam.

Here is a detailed video explaining the JAIIB IE&IFS October 2023 paper analysis.

IE&IFS 2023 PYQ analysis also helps you identify the important topics that you must cover to enhance your preparation for the paper.

Step 3: Identify Important Topics

By analyzing the PYQs, you can understand past trends and identify the most important topics. To make it easy for you, we have analyzed the IE & IFS May and October 2023 papers to identify the most important topics. Read below:

1. Module A

| Module A: Indian Economic Architecture | ||

| SNo. | Chapters | Topics |

| 1 | An Overview of the Indian Economy | Basic Characteristics of Indian Economy – World Bank Classification Economy till 2008 & after 2008 – Hindu Rate & Growth |

| 2 | Sectors of the Indian Economy | Role & Importance of Primary, Secondary & Tertiary Sector Sunrise Sector of Indian Economy |

| 3 | Economic Planning in India and NITI Aayog | Five Years Plans in India NITI Aayog – Strategy for New India @ 75 |

| 4 | Role of Priority Sector and MSME in the Indian Economy | List of Priority Sectors Identified in India & PSL Targets |

| 5 | Infrastructure, including Social Infrastructure | Energy Power, Transport system viz., Rail, Road, Civil Aviation – Initiative given |

| 6 | Economic Reforms | Economic Transformation – Financial Sector – Narasimham Committee |

| 7 | Foreign Trade Policy, Foreign Investments, and Economic Development | FDIs, FIIS, and Recent Trends |

| 8 | Climate Change, Sustainable Development Goals (SDGs) | India’s progress in SDGs, including Climate change, CSR Activities – Initiatives, CoP 26, CSR |

2. Module B

| Module B: Economic Concepts Related to Banking | ||

| SNo. | Chapters | Topics |

| 1 | Fundamentals of Economics, Microeconomics, Macroeconomics, and Types of Economies | Economics – An Introduction – The Three Definitions |

| 2 | Supply and Demand | Forces Behind the Demand Curve |

| 3 | Money Supply and Inflation | Money Supply – Measures, Money Multiplier, Velocity, Characteristics of Currency Measures of Inflation – CPI, WPI, GDP Deflator |

| 4 | Theories of Interest | Keynes’ Liquidity Preference Theory of Rate of Interest Effect of Fiscal and Monetary |

| 5 | Business Cycles | Characteristics of a Business Cycle |

| 6 | Monetary Policy and Fiscal Policy | GDP and Related Concepts Utility |

| 7 | National Income and GDP Concepts | FDIs, FIIS, and Recent Trends |

| 8 | Union Budget | Expenditure & Receipts |

3. Module C

| Module C: Indian Financial Architecture | ||

| SNo. | Chapters | Topics |

| 1 | Indian Financial System – An overview | Phase I & II: Bank Nationalization |

| 2 | Indian Banking Structure | Types of Banks |

| 3 | Banking Regulation Act, 1949 and RBI Act, 1934 | RBI Act, 1934 – Paid-up Capital and Board of Directors Banking Regulation Act, 1949 |

| 4 | Development Financial Institutions | Evolution of DFIs National Bank for Financing Infrastructure and Development (NaBFID) |

| 5 | Micro Finance Institutions | Evolution of Microfinance in India and PSL norms SHG-Bank Linkage |

| 6 | Non-Banking Financial Companies | NBFS Definition and types |

| 7 | Insurance Companies | Privatization and Foreign Direct Investment (FDI) in the Insurance Sector |

| 8 | Reforms & Developments in the Banking Sector | Bad Bank |

4. Module D

| Module D: Financial Products and Services | ||

| SNo. | Chapters | Topics |

| 1 | Overview of Financial Markets | Price Discovery |

| 2 | Money Markets and Capital Markets | Notice Money and Term Money Repo, LTRO, TLTRO |

| 3 | Fixed Income Markets – Debt/Bond Markets | Bond Valuation and Theorems Derivatives Association of India RBI Retail Direct Scheme (RDS) |

| 4 | Forex Markets | Foreign Exchange Management Act (FEA), 1999 |

| 5 | Interconnection of various markets/Market Dynamics | Asian Clearing Union |

| 6 | Merchant Banking Services | Definition and SEBI Regulations |

| 7 | Factoring, Forfaiting & TreDS | Definition & Types |

| 8 | Venture Capital | Concept of Venture Capital, Stages & Exit routes |

| 9 | Leasing and Hire Purchase | Definition, Types, and Parties Involved |

| 10 | Credit Rating Agencies and Their Functions | Credit Rating Agency (CRAs) – Definition & History |

| 11 | Insurance Products & Ch43. Pension Funds (include APY, NPS) | Government Products – Insurance (PMJJBY, PMSBY) & Pension (APT, PPF, NPS) |

| 12 | Real Estate Investment Funds/ Infrastructure Investment Fund | REITs & InvITs – Definition & Types |

After understanding the important topics, it’s time to start your preparation by prioritizing modules.

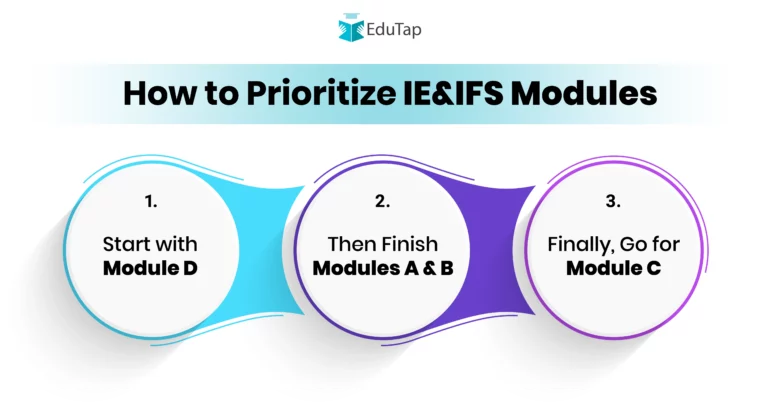

Step 4: Prioritize Modules

Prioritizing modules ensures that you allocate more time to crucial topics that carry higher weightage in the paper. But which module to start with?

Below, we have explained the sequence in which you should start your preparation.

1. Start with Module D

Module D is the king of all the modules for the IE&IFS paper. As mentioned earlier, the maximum number of questions usually come from Module D, making it the most important module to start your preparation with. Therefore, by beginning with Module D, you strategically address the core content that significantly influences your performance in the IE&IFS paper.

2. Then Finish Modules A & B

After Module D, start reading Modules A and B. These modules are related to each other, making it more beneficial to read them together. Moreover, Module B is the second-highest scoring module, following Module D.

3. Finally, Go for Module C

Keep Module C for the last, as it generally has the least number of questions. Additionally, the chapters in Module C are lengthy, demanding more time as compared to the other modules.

After prioritizing your modules, it’s time to start preparing according to the suggested preferences.

Step 5: Understand How to Cover Each Module

Below, we have mentioned the strategy to help you understand how to cover each module:

1. Cover Important Topics

As mentioned in the article above, you should start your preparation by covering the important topics from each module. You can divide the topics into manageable chunks and allocate time accordingly. Moreover, you must set realistic deadlines for completing each module.

2. Practice Consistently with Mock Tests and PYQs

After completing the important topics from each module, you should start practising PYQs and mock tests. It allows you to assess your understanding, identify areas for improvement, and practice time management. You must analyze your performance to pinpoint strengths and weaknesses, guiding further study efforts. Tailor your study plan accordingly, emphasizing areas that need improvement while maintaining proficiency in strong subjects.

3. Don’t Forget to Revise

Don’t underestimate the impact of revisiting key concepts and important topics. Regular and strategic revision not only reinforces your understanding but also helps in retaining information in the long run.

Now that you have understood how to cover each module, let’s understand the best books and resources to help you prepare for the IE&IFS paper.

Step 6: Identify Important Books and Resources

Here are the best books and sources to prepare for IE & IFS paper:

| Best Books and Sources for IE & IFS Preparation | ||||

| SNo. | Books | Author | Publisher | Buy Here |

| 1 | NCERT Economy Books for Class XI & XII | NCERT | NCERT | Buy Online |

| 2 | Indian Economy & Indian Financial System | IIBF | Macmillan | Buy Online |

Other Recommended Sources

Below are the other recommended sources that can help you further enhance your preparation.

1. IIBF e-Learning Portal

IIBF offers an e-learning portal where you can access digital study material, online courses, and mock tests to prepare for the IE&IFS paper. This is an excellent resource to enhance your understanding of the exam topics.

2. Online Learning Platforms

There are multiple online learning platforms that offer IE&IFS courses. These platforms offer a wide range of study materials, interactive lessons, practice quizzes, mock tests, and guidance from experienced educators.

3. YouTube Videos

EduTap JAIIB YouTube channel provides free insightful tutorials and explanations on important IE&IFS topics, allowing you to understand complex IE&IFS topics through quality video lectures.

After getting familiar with the important books and resources, let’s understand the timetable for the JAIIB IE&IFS preparation.

Step 7: Make a Practical Timetable

To prepare well for the IE&IFS paper, it is essential to create and follow a practical timetable. Here’s a module-wise sample timetable that you can customize according to your strengths, weaknesses, and the available time you have:

| Indian Economy and Indian Financial System | |||

| SNo. | Module | Time | Instructions |

| 1 | Module A: Indian Economic Architecture | 7 Hours |

|

| 2 | Module B: Economic Concepts Related To Banking | 5 Hours |

|

| 3 | Module C: Indian Financial Architecture | 6 Hours |

|

| 4 | Module D: Financial Products And Services | 12 Hours |

|

| Total | 30 Hours | ||

General Tips:

- Adjust the above timetable to suit your specific needs.

- Take short breaks (5-10 minutes) between sessions.

- Structure your study schedule to align with your daily routine. For working professionals, consider dedicating extended study periods on weekends to optimize exam preparation.

Here is a detailed video explaining the preparation strategy for IE&IFS.

Conclusion

Preparing for the IE&IFS paper demands a strategic and comprehensive approach. The strategic conquest of IE&IFS preparation begins with streamlining the vast syllabus to identify the important topics. Cover important topics of each module and start with Module D, as it holds the majority of questions. Practice mock tests and PYQs to identify your strengths and weaknesses, allowing you to analyze your progress, refine your strengths, and improve your weaknesses. Remember, success lies in consistent effort, strategic planning, and unwavering belief in yourself.

FAQs

While relying solely on books for your IE&IFS preparation is possible, the IIBF-recommended book is comprehensive and time-consuming. It’s advisable to use books for important topics and supplement your preparation with additional resources mentioned in the article above for a more efficient and thorough study.

Regular practice with mock tests, implementing time management strategies, and prioritizing questions can help enhance time management skills during the actual exam.

Module C is the least important module. You should keep it for the last, as fewer questions usually come from this module, and its chapters are lengthier compared to other modules.

Set short-term goals, celebrate small victories, and connect with fellow aspirants for mutual encouragement. Break down the study routine into manageable tasks. Moreover, seek advice and guidance from expert mentors.