Whenever a new aspirant plans to prepare for the Reserve Bank of India Grade B exam, the question that often arises is, “Is RBI Grade B a tough exam?” The truth is that the answer to this query is subjective and depends on various factors.

In this article, we’ll cover various factors based on which you can decide whether the RBI Grade B exam is tough, moderate or easy. We’ll also explain the subject-wise and year-wise difficulty level, and provide a comparison of RBI Grade B with other competitive exams.

Is RBI Grade B Tough?

In a country like India, where job opportunities are limited, securing a government position is a rare achievement. Hence, it’s evident that competitive exams, such as the RBI Grade B, will not be a piece of cake. It is a challenging examination that demands dedicated effort and thorough preparation.

Having said this, you must ask yourself.

“Why am I asking this question whether RBI Grade B is a tough exam?”

Is it because, at some level, you are afraid to take this exam and somehow want to convince yourself that the exam in itself is tough?

Or is it because you actually want to deeply understand what subjects and topics are actually tough and want to strategize your preparation accordingly?

It is essential that you answer the above two questions before reading this article because we firmly believe that if you are committed to dedicated preparation of the RBI Grade B exam, cracking the exam is achievable. Not easy, but achievable and you must not be under the impression that this exam can be cracked with minimal effort.

Is RBI Grade B Really Difficult to Crack?

Cracking the RBI Grade B exam may seem difficult for the following candidates:

1. If You Find it Difficult to Memorise Data

If you struggle to memorise information, cracking the RBI Grade B exam may pose a challenge. The exam demands significant factual knowledge; retaining this information is crucial for answering questions accurately.

2. If You Do Not Have an Economics or Finance Background

The exam can be challenging if you are new to Economics or Finance subjects. It doesn’t mean only candidates from Economics or Finance backgrounds can clear the exam. It means that candidates without such a background may require more time to learn the basics of these subjects before progressing to more advanced levels.

3. If You Do Not Have Clarity on Priority

Most of the time, candidates find RBI Grade B difficult because they don’t have clarity on their priorities. It means if you are preparing for the RBI Grade B exam along with such exams that do not have any considerable syllabus or pattern overlap with RBI Grade B, you are not doing justice to your preparation.

Is RBI Grade B Really Easy to Crack?

Cracking the RBI Grade B exam may seem easy for the following candidates:

1. If You Can Learn to be Selective

Be selective to get selected. The RBI Grade B exam has a vast syllabus; to cover most of the syllabus in a limited time, you need to be selective. You can cultivate a selective and effective study approach by comprehending the exam’s demands, identifying crucial topics, and determining the depth of understanding required.

2. Self-Believing

With self-belief, cracking the RBI Grade B exam becomes achievable. A significant observation reveals that over 70% of successful candidates come from non-Economics and Finance backgrounds.

This underscores the fact that individuals from diverse educational backgrounds can conquer the exam with careful preparation and dedication.

3. If You Have Clarity on Why

Cracking the exam will be easy if you can understand why you are taking the exam. To explain it further, let’s take an example of the Golden Circle by Simon Sinek.

The Golden Circle has three components: What, How, and most importantly, Why.

1. What

Almost every candidate can easily answer the “what” part of their preparation like:

“What do I need to prepare for the RBI Grade B exam?”

2. How

As compared to the what questions, the number of aspirants who are clear about the “how” of preparation would be less. Nevertheless, “how” questions are something the answers to which can be easily searched online.

For example:

“How do I prepare Finance for RBI Grade B”

“How do I make a study plan for the next 6 months?”

3. Why

You would agree that only a few select aspirants would be absolutely clear about the “why” of their preparation.

“Why am I preparing for the RBI Grade B exam?”

“Why am I investing my precious time, energy and other resources into cracking this exam?”

“Why am I getting up early or burning the midnight oil to see my name in that final list of RBI Grade B officers?”

Understanding the answers to the above questions is your “Why”.

It is the most important component as it gives you the clarity of taking the exam. Whether it’s for respect, salary, perks, or other benefits, a well-defined “Why” brings motivation, compelling you to exert effort and perform at your best.

Now that you have understood how easy or tough it is to crack the RBI Grade B exam, let’s look at some of the wrong conceptions about the toughness of the exam.

Can an Average Student Clear the RBI Grade B Exam?

Before we answer this question, let’s find out what an average student is.

What is an Average Student?

There is no exact definition of an average student, as perspectives on intelligence and achievement vary widely. Some associate it with a lower IQ, while others tie it to not hailing from UPSC, IIT, or IIM backgrounds.

However, in reality, we see numerous successful persons who don’t fit these traditional moulds. For example, icons like Kalpana Chawla, who had an aeronautical engineering degree from Punjab Engineering College, later became an astronaut. Also, Satya Nadella, who has an engineering degree from the Manipal Institute of Technology, is Microsoft’s CEO.

Contrary to popular belief, it is inaccurate to label individuals as average students solely based on whether they come from an IIT or IIM background. You need to understand that no student is average, the hard work they put in preparing for the RBI Grade B Exam can be average.

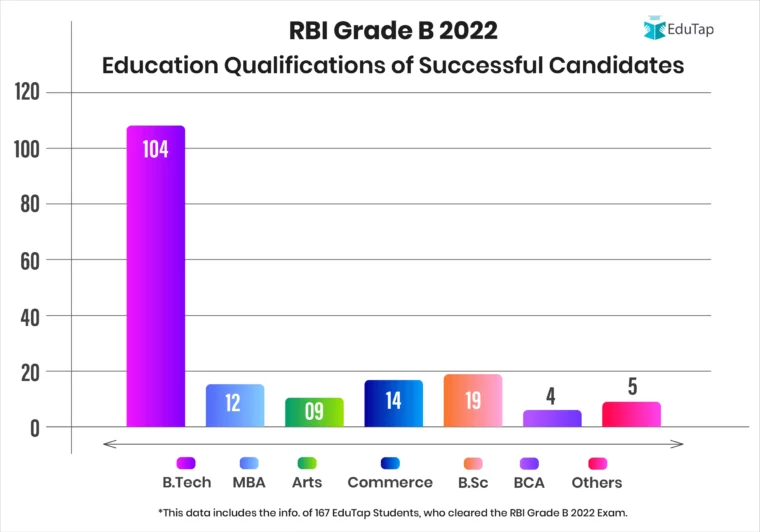

To explain it further, let’s take a look at the education qualifications, work experience, and gap years of candidates who cleared the RBI Grade B 2022 exam.

Educational Qualification

Analysing the educational backgrounds of EduTap Students who cracked the RBI Grade B 2022 exam, you can see that only a few candidates were from MBA or Commerce background. The majority of candidates hailed from B.Tech. background, with only a modest 10% representing graduates from IITs.

Furthermore, diversity is evident, with successful candidates holding qualifications in B.Sc, Arts, BCA, and various other fields. So, don’t worry if you are not from an MBA or Commerce background. You can still crack the RBI Grade B exam.

After understanding the educational qualifications of successful candidates who cracked the RBI Grade B 2022 exam, let’s talk about their work experience.

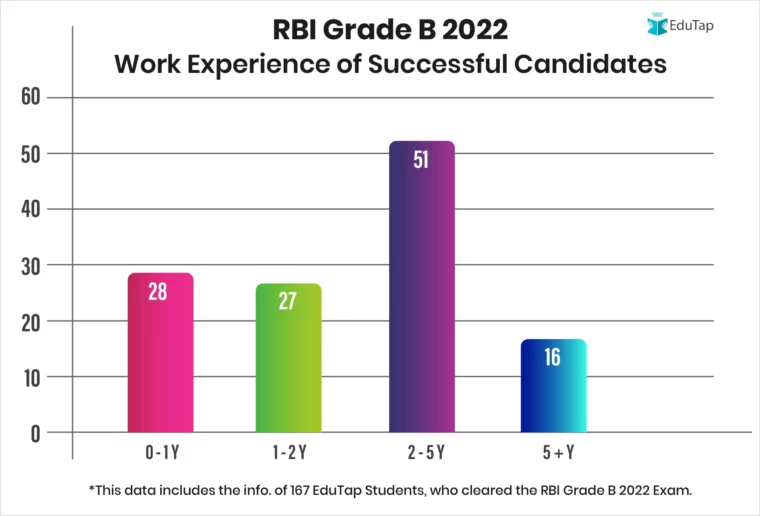

Work Experience

Among the 167 EduTap students who successfully cleared the RBI Grade B 2022 exam, 124 possessed prior work experience, while 45 of the selected candidates had no work experience. Additionally, 28 students had less than 1 year of experience. The data underscores that success in the RBI Grade B exam is achievable irrespective of prior work experience.

It also highlights the fact that candidates with busy work schedules, often constrained by limited time for study, can still clear the exam. The key to their success is that they emphasise focused study rather than relying solely on the number of study hours.

After understanding the work experience of successful candidates who cracked the RBI Grade B 2022 exam, let’s talk about their gap years.

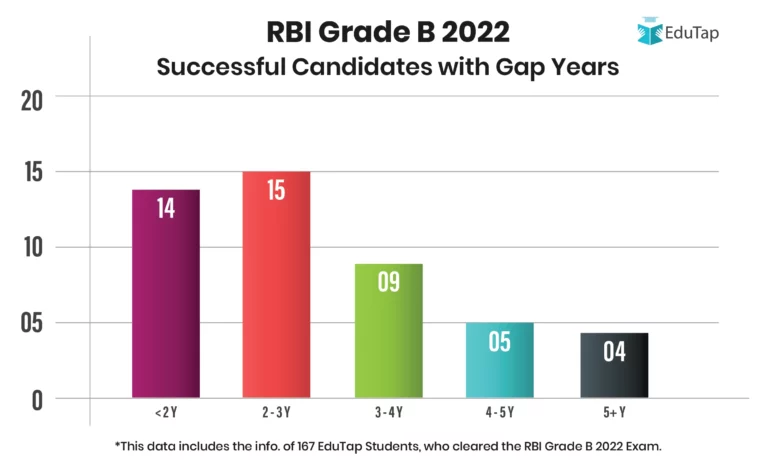

Gap Years

Out of the 167 EduTap students who successfully cleared the RBI Grade B 2022 exam, 47 had gap years in their education. Notably, 14 of them had gap years without acquiring any work experience. This reaffirms that success in the RBI Grade B exam is achievable regardless of gap years.

In conclusion, your marks, educational qualifications, work experience, and gap years do not define your intelligence. The true measure of intelligence lies in how dedicatedly you study for the exam.

Here is a detailed video explaining “Can an average student clear the RBI Grade B exam?”.

Now that you have the answer to “Can an average student clear the RBI Grade B exam?”, let’s find out the difficulty level of the RBI Grade B Phase 1 and 2.

Difficulty Level of RBI Grade B Phase 1 and 2

Below, we have mentioned the subject-wise difficulty level of the RBI Grade B Phase 1 and Phase 2.

Reasoning Difficulty Level

The table below contains the year-wise distribution of easy, moderate, and difficult questions out of the total number of reasoning questions from 2017 to 2023.

| Reasoning Difficulty Level | |||||||

| 2023 | 2022 | 2021 | 2019 | 2018 | 2017 | ||

| Total Questions | 60 | 60 | 60 | 60 | 60 | 60 | |

| Difficulty Level | Easy | 6 | 5 | 5 | 20 | 14 | 8 |

| Moderate | 27 | 15 | 10 | 30 | 25 | 21 | |

| Difficult | 27 | 40 | 45 | 10 | 21 | 31 | |

Overall Reasoning Difficulty Level

- 2023: Moderate to Difficult

- 2022: Moderate to Difficult

- 2021: Moderate to Difficult

- 2019: Easy to Moderate

- 2018: Moderate to Difficult

- 2017: Moderate to Difficult

Key Takeaway

Each year, the RBI Grade B reasoning section has a mix of easy, moderate, and difficult questions, with a prevailing trend towards moderate to difficult ones. However, it is important to note that in 2023, the reasoning cut-off is just 9 marks out of 60, making it crucial to practise moderate-level questions, especially if the reasoning is not your strong suit, to clear the subject cut-off.

Quantitative Aptitude Difficulty Level

The table below contains the year-wise distribution of easy, moderate, and difficult questions out of the total number of quant questions from 2017 to 2023.

| Quantitative Aptitude Difficulty Level | |||||||

| 2023 | 2022 | 2021 | 2019 | 2018 | 2017 | ||

| Total Questions | 30 | 30 | 30 | 30 | 30 | 30 | |

| Difficulty Level | Easy | 1 | 2 | 03 | 21 | 17 | 4 |

| Moderate | 2 | 13 | 04 | 09 | 13 | 14 | |

| Difficult | 21 | 15 | 23 | 0 | 0 | 12 | |

Overall Quantitative Aptitude Difficulty Level

- 2023: Difficult

- 2022: Moderate to Difficult

- 2021: Difficult

- 2019: Easy to Moderate

- 2018: Easy to Moderate

- 2017: Moderate to Difficult

Key Takeaway

Over the years, a consistent pattern emerges, indicating a tendency towards difficulty, particularly in the quantitative aptitude section. However, it is important to note that in 2023, the quant cut-off was 4.5 marks out of 30. While the overall difficulty level may be high, achieving the sectional cut-off was achievable with practice.

General Awareness (GA) Difficulty Level

The table below contains the year-wise distribution of easy, moderate, and difficult questions out of the total number of GA questions from 2017 to 2023.

| GA Difficulty Level | |||||||

| 2023 | 2022 | 2021 | 2019 | 2018 | 2017 | ||

| Total Questions | 80 | 80 | 80 | 80 | 80 | 80 | |

| Difficulty Level | Easy | 15 | 28 | 30 | 34 | 25 | 30 |

| Moderate | 40 | 35 | 31 | 40 | 45 | 42 | |

| Difficult | 25 | 17 | 19 | 6 | 10 | 8 | |

Overall GA Difficulty Level

- 2023: Moderate

- 2022: Easy to Moderate

- 2021: Easy to Moderate

- 2019: Easy to Moderate

- 2018: Easy to Moderate

- 2017: Easy to Moderate

Key Takeaway

Over the years, the distribution between easy, moderate, and difficult levels of GA remains relatively stable. With the sectional cut-off of 12 marks out of 80, candidates can easily achieve this by maintaining a balanced focus on easy and moderately challenging questions.

English Difficulty Level

The table below contains the year-wise distribution of easy, moderate, and difficult questions out of the total number of English questions from 2017 to 2023.

| English Difficulty Level | ||

| SNo. | Year | Difficulty Level |

| 1 | 2023 | Easy to Moderate |

| 2 | 2022 | Moderate to Difficult |

| 3 | 2021 | Moderate to Difficult |

| 4 | 2019 | Easy to Moderate |

| 5 | 2018 | Moderate to Difficult |

| 6 | 2017 | Moderate to Difficult |

Overall English Difficulty Level

The overall English difficulty level is Moderate to Difficult.

Key Takeaway

The overall difficulty level for the English section falls within the range of Moderate to Difficult.

Notably, the cut-off was merely 4.5 out of 30 marks in 2023, emphasising that candidates can effortlessly meet and exceed this cut-off threshold with a well-crafted preparation strategy.

Important Note:

Candidates can easily clear the sectional cut-off of individual subjects. However, they also need to clear the overall cut-off of Phase 1 which was 54.25 for the general category in 2023.

Understanding the cut-offs for individual subjects allows students to tailor their exam preparation based on their strengths and weaknesses. For example, students can focus on meeting the cut-off for a particular subject where they face difficulties and leverage their strong subjects, to surpass the overall cut-off for the RBI Grade B Phase 1 exam.

Finance and Management (Objective) Difficulty Level

The table below contains the year-wise distribution of easy, moderate, and difficult questions out of the total number of objective finance and management questions from 2019 to 2023.

| Finance and Management Difficulty Level (Objective) | |||||

| 2023 | 2022 | 2021 | 2019 | ||

| Total Questions | 30 | 30 | 30 | 75 | |

| Difficulty Level | Easy | 25 | 16 | 23 | 51 |

| Moderate | 5 | 11 | 6 | 13 | |

| Difficult | 0 | 3 | 1 | 1 | |

Overall Finance and Management Objective Difficulty Level

- 2023: Easy

- 2022: Easy to Moderate

- 2021: Easy

- 2019: Easy

Key Takeaway

The objective Finance and Management section has shown a consistent trend, featuring many easy questions in recent years. Candidates should leverage this pattern to streamline their preparation by mastering fundamental concepts.

Finance and Management (Descriptive) Difficulty Level

The table below contains the year-wise distribution of easy, moderate, and difficult questions out of the total number of descriptive finance and management questions from 2021 to 2023.

| Finance and Management Difficulty Level (Descriptive) | ||||

| 2023 | 2022 | 2021 | ||

| Total Questions | 6 | 6 | 6 | |

| Difficulty Level | Easy | 1 | 2 | 5 |

| Moderate | 5 | 4 | 1 | |

| Difficult | 0 | 0 | 0 | |

Overall Finance and Management Descriptive Difficulty Level

- 2023: Easy to Moderate

- 2022: Easy to Moderate

- 2021: Easy

Key Takeaway

The descriptive Finance and Management section reflects a consistent pattern of easy to moderate-level questions. This data shows a manageable difficulty level, underscoring the need for adaptive preparation.

Descriptive English Difficulty Level

The table below contains the year-wise distribution of easy, moderate, and difficult questions out of the total number of English essay questions from 2021 to 2023.

| English Essay Difficulty Level | |||||

| 2023 | 2022 | 2021 | 2019 | ||

| Total Questions | 4 | 4 | 4 | 5 | |

| Difficulty Level | Easy | 1 | 1 | 1 | 2 |

| Moderate | 2 | 2 | 2 | 2 | |

| Difficult | 1 | 1 | 1 | 1 | |

Overall Descriptive English Difficulty Level

- 2023: Moderate

- 2022: Moderate

- 2021: Moderate

- 2019: Easy to Moderate

Key Takeaway

The overall difficulty level in the English Essay section exhibits a consistent pattern over the years. This consistency implies that candidates can anticipate a well-rounded mix of difficulty levels in the English Essay section over the years.

Economic and Social Issues (Objective) Difficulty Level

The table below contains the year-wise distribution of easy, moderate, and difficult questions out of the total number of objective economic and social issues questions from 2019 to 2023.

| Economic and Social Issues Difficulty Level (Objective) | |||||

| 2023 | 2022 | 2021 | 2019 | ||

| Total Questions | 30 | 30 | 30 | 65 | |

| Difficulty Level | Easy | 6 | 9 | 9 | 22 |

| Moderate | 18 | 14 | 12 | 32 | |

| Difficult | 6 | 7 | 9 | 11 | |

Overall Economic and Social Issues Objective Difficulty Level

The overall Economic and Social Issues objective difficulty level is Moderate.

- 2023: Moderate

- 2022: Moderate

- 2021: Moderate

- 2019: Easy to Moderate

Key Takeaway

The overall difficulty level of the ESI objective presents a balanced distribution across difficulty levels with a predominant focus on moderate questions. To excel, aspirants should ensure comprehensive preparation across all difficulty levels.

Economic and Social Issues (Descriptive) Difficulty Level

The table below contains the year-wise distribution of easy, moderate, and difficult questions out of the total number of descriptive economic and social issues questions from 2021 to 2023.

| Economic and Social Issues Difficulty Level Phase 2 (Descriptive) | ||||

| 2023 | 2022 | 2021 | ||

| Total Questions | 6 | 6 | 6 | |

| Difficulty Level | Easy | 3 | 2 | 2 |

| Moderate | 0 | 2 | 2 | |

| Difficult | 3 | 2 | 2 | |

Overall Economic and Social Issues Descriptive Difficulty Level

- 2023: Moderate

- 2022: Moderate

- 2021: Moderate

Key Takeaway

The overall difficulty level of ESI descriptive is moderate. Candidates should tailor their preparation by focusing on understanding key concepts, staying updated on relevant issues, and practising descriptive writing to navigate this section effectively.

To further understand the difficulty level of the RBI Grade B exam, let’s take a look at its comparison with other competitive exams.

RBI Grade B Vs. Other Competitive Exams

Below, we have compared various competitive exams, such as NABARD Grade A, CAT, SSC CGL, etc., to help you understand the difficulty level of the RBI Grade B exam.

RBI Grade B vs NABARD Grade A, Which is Tough?

Determining whether RBI Grade B or NABARD Grade A is tougher depends on various factors and individual perspectives. Here are some considerations to help you make an informed comparison:

| RBI Grade B vs NABARD Grade A | ||

| RBI Grade B | NABARD Grade A | |

| No. of Vacancies | Around 200-250 222 (2023) 238 (2022) | 150-200 150 (2023) 170 (2022) |

| No. of Applicants | Around 2+ lakh applicants | More than 74,000 applicants |

| Exam Pattern | It has 3 Phases, Phase 1 (Pre) Phase 2 (Mains) Phase 3 (Interview) Phase 2 includes both objective and descriptive papers. | It also has 3 Phases, Phase 1 (Pre) Phase 2 (Mains) Phase 3 (Interview) Phase 2 includes both objective and descriptive papers. |

| Syllabus | It covers Economic and Social Issues, Finance and Management, and Descriptive English. It also requires Reasoning, General Awareness, Quantitative Aptitude, and English Language. | Emphasises Agriculture and Rural Development, Economic and Social Issues, and a professional knowledge test based on the chosen discipline. It also includes Reasoning, Computer Knowledge, Quantitative Aptitude, and English Language. |

| Cut-Offs*(2023) | Phase 1: 54.25 (200) Phase 2: 171.25 (300) Final: 234.50 | Phase 1: 41.75 (200) Phase 2: NA Final: NA |

| Cut-offs can vary from year to year, and the level of competition depends on the number of vacancies and applicants. | ||

| Personal Interest | RBI Grade B might be more suitable if you are strongly inclined towards finance and banking. | NABARD Grade A could be a better fit if you are passionate about rural development. |

| Exam Difficulty | The perception of difficulty can vary among candidates. Some may find the economic and financial concepts of RBI Grade B challenging, while others may find the agricultural and rural development aspects of NABARD Grade A challenging. | |

RBI Grade B vs CAT, Which is Tough?

Determining whether RBI Grade B or CAT is tougher depends on various factors and individual perspectives. Here are some considerations to help you make an informed comparison:

| RBI Grade B vs CAT | ||

| RBI Grade B | CAT | |

| No. of Vacancies | Around 200-250 222 (2023) 238 (2022) | Around 5500 Seats (Across various IIMs) |

| No. of Applicants | Around 2+ lakh applicants | Around 2+ lakh applicants |

| Exam Pattern | It has 3 Phases, Phase 1 (Pre) Phase 2 (Mains) Phase 3 (Interview) Phase 2 includes both objective and descriptive papers. | It has 3 Phases, Preliminary Screening Written Ability Test (WAT) Personal Interview (PI) |

| Syllabus | It covers Economic and Social Issues, Finance and Management, and Descriptive English. It also requires Reasoning, General Awareness, Quantitative Aptitude, and English Language. | The CAT 2023 syllabus comprises Verbal Ability and Reading Comprehension (VARC), Data Interpretation and Logical Reasoning (DILR), and Quantitative Aptitude (QA). |

| Cut-Offs*(2023) | Phase 1: 54.25 (200) Phase 2: 171.25 (300) Final: 234.50 | Qualifying IIM cut-off 2023 is over the 90 percentile for all IIMs. The final CAT cut-off will be 99+ percentile for all the best IIMs and 95+ for the new IIMs. |

| Cut-offs can vary from year to year, and the level of competition depends on the number of vacancies and applicants. | ||

| Personal Interest | RBI Grade B might be more suitable if you are strongly inclined towards finance and banking. | CAT could be the preferred choice if you aspire to pursue a career in general management, strategy, or consulting. |

| Exam Difficulty | Comparing the difficulty of RBI Grade B and CAT is challenging as they cater to different career paths. RBI Grade B specialises in banking and finance, while CAT is a management entrance exam. | |

Important Note: Cat is an entrance test to post-graduation and does not guarantee a job after clearing the exam.

RBI Grade B vs SSC CGL, Which is Tough?

Determining whether RBI Grade B or SSC CGL is tougher depends on various factors and individual perspectives. Here are some considerations to help you make an informed comparison:

| RBI Grade B vs SSC CGL | ||

| RBI Grade B | SSC CGL | |

| No. of Vacancies | Around 200-250 222 (2023) 238 (2022) | Around 7000-9000 8,440 (2023) 36,012 (2022) (The increase in the vacancies in 2022 is due to the inclusion of PA/SA posts in the SSC CGL exam) |

| No. of Applicants | Around 2+ lakh applicants | Over 30 lakh applicants |

| Exam Pattern | It has 3 Phases, Phase 1 (Pre) Phase 2 (Mains) Phase 3 (Interview) Phase 2 includes both objective and descriptive papers. | It has 2 Tiers, Tier 1 (Pre) Tier 2 (Mains) There is no descriptive paper. |

| Syllabus | It covers Economic and Social Issues, Finance and Management, and Descriptive English. It also requires Reasoning, General Awareness, Quantitative Aptitude, and English Language. | The syllabus includes General Intelligence and Reasoning, General Awareness, Quantitative Aptitude, and English Comprehension. |

| Cut-Offs*(2023) | Phase 1: 54.25 (200) Phase 2: 171.25 (300) Final: 234.50 | Tier 1: 169.67168 (200) Tier 2: 287 (400) Final: 287 |

| Cut-offs can vary from year to year, and the level of competition depends on the number of vacancies and applicants. | ||

| Personal Interest | RBI Grade B might be more suitable if you are strongly inclined towards finance and banking. | For a broader range of government roles, SSC CGL provides diverse career opportunities. |

| Exam Difficulty | The limited vacancies and relatively high number of applicants make the RBI Grade B exam competitive. Due to its specific focus, it may be difficult for those without a financial background. The abundance of vacancies and a larger pool of applicants for the SSC CGL exam indicate high competition. It may be challenging due to the sheer competition and the need for proficiency in quantitative aptitude, reasoning, English, and general awareness. | |

RBI Grade B vs SBI PO, Which is Tough?

Determining whether RBI Grade B or SBI PO is tougher depends on various factors and individual perspectives. Here are some considerations to help you make an informed comparison:

| RBI Grade B vs SBI PO | ||

| RBI Grade B | SBI PO | |

| No. of Vacancies | Around 200-250 222 (2023) 238 (2022) | Around 1500-2200 2000 (2023) 1673 (2022) |

| No. of Applicants | Around 2+ lakh applicants | Approximately 10 lakh applicants |

| Exam Pattern | It has 3 Phases, Phase 1 (Pre) Phase 2 (Mains) Phase 3 (Interview) Phase 2 includes both objective and descriptive papers. | It has 3 Phases, Phase 1 (Prelims) Phase 2 (Mains and Psychometric Test) Phase 3 (Interview and Group Exercises) |

| Syllabus | It covers Economic and Social Issues, Finance and Management, and Descriptive English. It also requires Reasoning, General Awareness, Quantitative Aptitude, and English Language. | It evaluates candidates on Reasoning and Computer Aptitude, English Language, Data Analysis and Interpretation, and General Economy and Banking Awareness. |

| Cut-Offs*(2023) | Phase 1: 54.25 (200) Phase 2: 171.25 (300) Final: 234.50 | Phase 1: 59.25 (100) Phase 2: NA (200+50) Final: NA |

| Cut-offs can vary from year to year, and the level of competition depends on the number of vacancies and applicants. | ||

| Personal Interest | If you have a strong inclination towards finance and banking and are interested in a specialised role, RBI Grade B might be more suitable. | If you also have a strong inclination towards finance and banking but are interested in a general leadership role, SBI PO might be right for you. |

| Exam Difficulty | Candidates without a strong background in finance and economics may find the RBI Grade B exam challenging. SBI PO may be difficult for those who find managing the extensive syllabus challenging, as it covers the English language, quantitative aptitude, reasoning ability, and general awareness. | |

RBI Grade B vs SEBI Grade A, Which is Tough?

Determining whether RBI Grade B or SEBI Grade A is tougher depends on various factors and individual perspectives. Here are some considerations to help you make an informed comparison:

| RBI Grade B vs SEBI Grade A | ||

| RBI Grade B | SEBI Grade A | |

| No. of Vacancies | Around 200-250 222 (2023) 238 (2022) | Around 80-120 NA (2023) 120 (2022) |

| No. of Applicants | Around 2+ lakh applicants | Around 20,000+ applicants |

| Exam Pattern | It has 3 Phases, Phase 1 (Pre) Phase 2 (Mains) Phase 3 (Interview) Phase 2 includes both objective and descriptive papers. | It also has 3 Phases, Phase 1 (Pre) Phase 2 (Mains) Phase 3 (Interview) Phase 2 includes both objective and descriptive papers. |

| Syllabus | It covers Economic and Social Issues, Finance and Management, and Descriptive English. It also requires Reasoning, General Awareness, Quantitative Aptitude, and English Language. | Focus on Securities Markets, Financial Regulations, and Legal Aspects Related to Securities. It also includes Reasoning, General Awareness, Quantitative Aptitude, and English Language. |

| Cut-Offs*(2023) | Phase 1: 54.25 (200) Phase 2: 171.25 (300) Final: 234.50 | Phase 1: 80 (200) Phase 2: 124.68 (200) Final: 64.82 (100) |

| Cut-offs can vary from year to year, and the level of competition depends on the number of vacancies and applicants. | ||

| Personal Interest | RBI Grade B might be more suitable if you are strongly inclined towards finance and banking. | SEBI Grade A could be a better fit if you are interested in securities markets and financial regulations. |

| Exam Difficulty | Both exams are considered challenging. RBI Grade B may be challenging for candidates without a strong background in economics and finance. On the other hand, SEBI Grade A may be challenging for those without a solid understanding of securities and financial regulations. | |

After comparing the RBI Grade B exam with the other competitive exams, let’s understand its preparation strategy.

6-Month RBI Grade B Preparation Strategy

If you have made it this far, you have already understood what subjects and topics are actually tough and now you really want to strategize your preparation accordingly. So, here is our 6-month preparation strategy. It is an integrated study plan that’ll help you cover the RBI Grade B exam syllabus for both Phase 1 and Phase 2.

Please note that if you find a particular subject or topic demanding more time, you can adjust this study plan accordingly.

For a better understanding, we have explained the RBI Grade B strategy in the following manners:

- Week-Wise Study Plan

- Day-Wise Study Plan

- Subject-Wise Study Plan

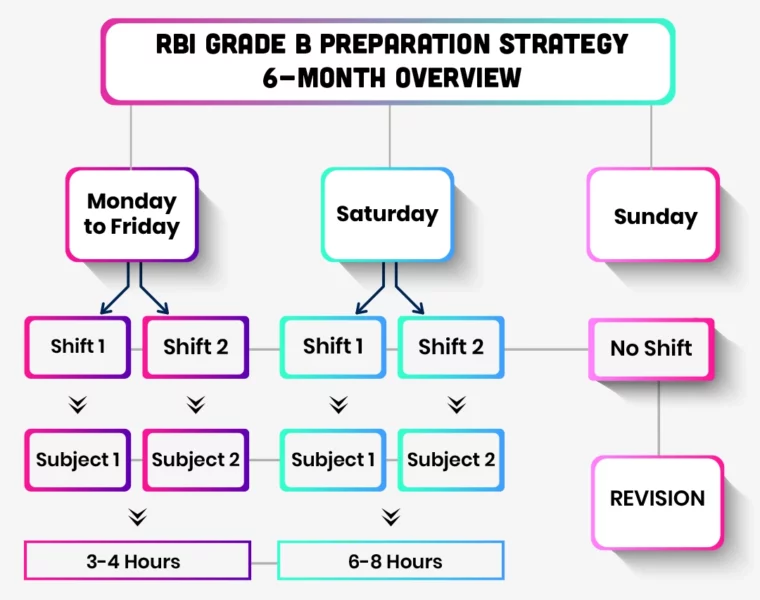

But before jumping on the study plan, you must understand that we have utilised 7 days of the week and further divided them into 3 sections:

- Monday to Friday: You need to dedicate a total of 3-4 hours daily to cover 2 subjects in 2 shifts.

- Saturday: You need to dedicate a total of 6-8 hours daily to cover 2 subjects in 2 shifts.

- Sunday: We have kept Sunday for the weekly revision. On Sunday, you should revise the topics that you have covered in a week.

We’ve crafted this strategy with the understanding that most aspirants work from Monday to Friday. Hence, we extend hours on Saturday and keep Sunday for revision. Below is the overview of our 6-Month RBI Grade B preparation strategy.

You can start our RBI Grade B strategy plan from Monday of any week. In this strategy, we have given priority to the topics based on the detailed analysis of the previous years’ papers.

After understanding the overview of the RBI Grade B study plan, let’s look at the week-wise strategy, allowing you to understand how to follow this plan.

Week-Wise 6-Month RBI Grade B Strategy

Here is the 6-month strategy for the RBI Grade B 2024 exam, divided into 26 weeks.

| Week-Wise 6-Month RBI Grade B Strategy | ||||

Week | Shift 1 | Shift 2 | ||

| Subject 1 | Days + Time | Subject 2 | Days + Time | |

| 1-5 | Management | Mon to Fri: 3 Hours Sat: 6 Hours | Reasoning | Mon to Fri: 1 Hour Sat 2: Hours |

| 6-8 | Finance | Mon to Fri: 2 Hours Sat: 4 Hours | Reasoning | Mon to Fri: 1 Hour Sat: 2 Hours |

| 9-16 | Finance | Mon to Fri: 2 Hours Sat: 4 Hours | Quantitative Aptitude | Mon to Fri: 2 Hours Sat: 4 Hours |

| 17-18 | General English | Mon to Fri: 2 Hours Sat: 4 Hours | Economic & Social Issues | Mon to Fri: 2 Hours Sat: 4 Hours |

| 19-20 | Current Affairs | Mon to Fri: 2 Hours Sat: 4 Hours | Economic & Social Issues | Mon to Fri: 2 Hours Sat: 4 Hours |

| 21 | Current Affairs | Mon to Fri: 2 Hours Sat: 4 Hours | Descriptive English | Mon to Fri: 2 Hours Sat: 4 Hours |

| 22-26 | Current Affairs | Mon to Fri: 3 Hours Sat: 6 Hours | Revision of QRE | Mon to Fri: 1 Hour Sat: 2 Hours |

Read the article explaining how to crack the RBI Grade B exam in First Attempt to understand day-wise study plan for each subject.

Conclusion

The question of whether RBI Grade B is a tough exam lacks a one-size-fits-all answer. The perceived difficulty of the exam is subjective and varies among aspirants based on their individual strengths, educational backgrounds, and preparation strategies. While the RBI Grade B exam is known for its specialisation in economics and finance, success is achievable through dedicated and strategic preparation.

FAQs

The RBI Grade B exam is challenging due to its focus on economic and financial concepts. The inclusion of a descriptive paper in English further adds to the complexity.

To improve English writing skills, practice writing essays and precis regularly. Actively seek constructive feedback to identify your errors and work on refining your writing.

While coaching classes are not mandatory, they can provide structured guidance and support. Additionally, they provide essential study materials, streamlining the process and saving you the time and effort of navigating through numerous sources. Self-study, combined with online resources and mock tests, can also be effective for preparation.

While a strong mathematical background is beneficial, the emphasis on maths in the RBI Grade B exam is comparatively lower than the other competitive exams. This is because the mathematical section is limited to Phase 1 and is qualifying in nature. In the RBI Grade B preparation, focusing more on the Economic and Finance components is essential.