In this article, we’ll provide a detailed analysis of the PPB paper held on 16 June 2024 and equip you with insights such as the overall and module-wise difficulty level of the paper, the distribution of questions across modules, the types of questions asked, comparison with the PPB paper held in October 2023 and recommendations for study resources to prepare for this paper.

JAIIB PPB June 2024: Topics Asked and Difficulty Level

In the below table, you will find the list of chapters, topics and sub-topics from which questions were asked in the paper held in June 2024.

Module A

| Chapter Name | Topic Name | Sub Topic Name | Question Difficulty |

| Banker Customer Relationship | Services to Customers & Investors | Third Party Product Sale | Moderate |

| Merchant Banking | Moderate | ||

| Lease Financing | Easy | ||

| Requirements to be Called a Bank | Banking Definition | Easy | |

| AML-KYC Guidelines | Organisational Set-up for AML | Designated Director | Moderate |

| Principal Officer | Moderate | ||

| Money Laundering | Process of Money Laundering | Easy | |

| Opening Accounts of Various Types of Customers | Accounts of Other Customers | HUF | Moderate |

| LLP | Moderate | ||

| Private Limited Companies | Easy | ||

| Legal Entity Identifier | Legal Entity Identifier | Difficult | |

| Operational Aspects of Deposit Accounts | Inoperative Accounts & Unclaimed Deposits | Depositor Education and Awareness Fund | Difficult |

| Salient Features of Deposit Accounts | Certificate of Deposits | Easy | |

| Operational Aspects of Handling Clearing/Collection/Cash | Security Measures at Branches & ATMs | Detection & Impounding of Counterfeit Notes | Difficult |

| Banker’s Special Relationship | Banker’s Lien | Banker’s Lien | Easy |

| Foreign Exchange Remittance Facilities for Individuals | Outward Remittances | Transactions which require prior approval of the Central Government | Difficult |

| Operational Aspects of NRI Business | Permitted A/Cs in India for NRIs & PIOs | Loan Against NRE Term Deposits | Difficult |

| Payment and collection of cheques and other Negotiable Instruments | Liability of the Paying Bank | Lost cheque | Difficult |

| Crossing of Cheques | Special Crossing | Difficult | |

| Ancillary Services | Safe Deposit Lockers | Locker Hiring | Easy |

| Demand Draft | Debtor based Case Study | Difficult | |

| Creditor Based Case Study | Difficult | ||

| Duties & Rights of a Banker and Customer Rights | Garnishee Order | Garnishee Order | Easy |

Module B

| Chapter Name | Topic Name | Sub-Topic Name | Question Difficulty |

| Principles of Lending | Types of Borrowers | LLP | Difficult |

| Appraisal and Assessment of Credit Facilities | Assessment of Working Capital | Maximum Permissible Bank Finance Method | Difficult |

| Working Capital Numerical | Moderate | ||

| Turnover Method Numerical | Moderate | ||

| Components of Working Capital | Easy | ||

| Assessment of Term Loans | Debt Service Coverage Ratio | Difficult | |

| Operational Aspects of Loan Accounts | Operational Aspects of Common Loan Products | Education Loan | Moderate |

| Credit Monitoring | CERSAI | Easy | |

| CRILC | Difficult | ||

| Types of Collaterals and their Characteristics | Types of Securities | Asset as Collateral | Difficult |

| Advance Against Life Insurance Policy | Disadvantages of Assignment | Difficult | |

| Different Modes of Charging Securities | Types of Charges | Hypothecation | Difficult |

| Assignment | Easy | ||

| Loan Against Term Deposit | Loan Against Term Deposit | Moderate | |

| Essentials of a Contract | Meaning of Contract | Easy | |

| Important Laws Relating to Recovery of Dues | Insolvency & Bankruptcy Code,2016 | Adjudicating Authority | Easy |

| Contracts of Guarantee & Bank Guarantee | Consideration | Bank Guarantee Consideration | Difficult |

| Letters of Credit | Uniform Customs and Practices for Documentary Credits | UCPDC 600 | Moderate |

Module C

| Chapter Name | Topic Name | Sub-Topic Name | Question Difficulty |

| Essentials of Bank Computerisation | Networking Technologies in Bank | Network Devices | Difficult |

| Alternate Delivery Channels | Electronic Banking | Tele Banking | Easy |

| Automated Teller Machine | Kiosk Banking | Moderate | |

| Brown Label ATMs | Easy | ||

| Electromagnetic Card | Charge Cards | Moderate | |

| Data Communication Network and EFT Systems | Data Communication Networks | Message Switch | Difficult |

| Microwaves System | Moderate | ||

| Optical Fibre | Easy | ||

| Automated Clearing System | CHAPS | Easy | |

| Emergence of Electronic Payment System in India | EFT Systems | Moderate | |

| Digital Payment Systems – NPCI | Electronic Clearing Systems in India | NACH | Easy |

| National Payment Corporation of India | National Financial Switch | Moderate | |

| IMPS | Moderate | ||

| UPI 2.0 | Moderate | ||

| Impact of Technology Adoption & Trends in Banking Technology | Emerging Technology Trends in Banking | Wearables | Easy |

| Artificial Intelligence | |||

| Security Considerations and Mitigation Measures in Banks | Information System Security | DDoS Attack | Moderate |

| Phishing | Easy | ||

| Technology Trends in Banking | e-RUPI | e-RUPI | Moderate |

Module D

| Chapter Name | Topic Name | Sub-Topic Name | Question Difficulty |

| Ethics, Business Ethics & Banking | Ethics & Business Values | Business Ethics: Myths and Reality | Easy |

| Ethical Foundation of Banking | Neutrality | Easy | |

| Ethics in Indian Context | Satyam & Its Lessons | Difficult | |

| Ethical Foundation of being Professional | Ethical Issues for Professionals | Moderate | |

| Global Financial Crisis | How Unethical Practices Triggered the Crisis | Difficult | |

| Ethics at the Individual Level | Values | Values Classification | Moderate |

| Personal Ethics & Business Ethics | Individual Responsibility | Moderate | |

| Ethical Dilemmas | Resolving Dilemmas | Moderate | |

| Ethical Dimensions: Employees | Managing Conflict of Interest | Managing Conflict of Interest | Moderate |

Note: The above data is based on 69 recollected questions of the JAIIB PPB June 2024 paper. We could not collect all 100 questions.

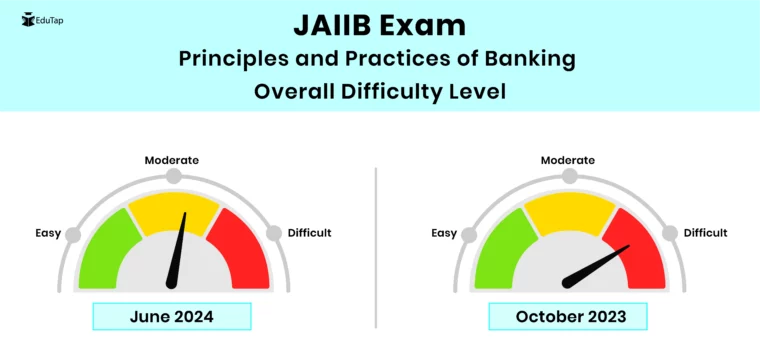

Now let’s understand the overall difficulty level of the Principles and Practices of Banking (PPB) paper held in June 2024.

JAIIB PPB June 2024: Overall Difficulty Level

The PPB paper held on 16 June 2024 was of moderate difficulty level. It is important to note that the October 2023 paper of PPB was of a higher difficulty level.

Key Observations – Shifting difficulty levels should not impact the student’s priority for the PPB component of the JAIIB exam, as the large syllabus makes comprehensive coverage challenging. Typically, the paper is of moderate to difficult level, and even an easier paper can seem difficult due to its length. Students find it challenging to finish the paper in 2 hours. So, quality practice before the exam is necessary.

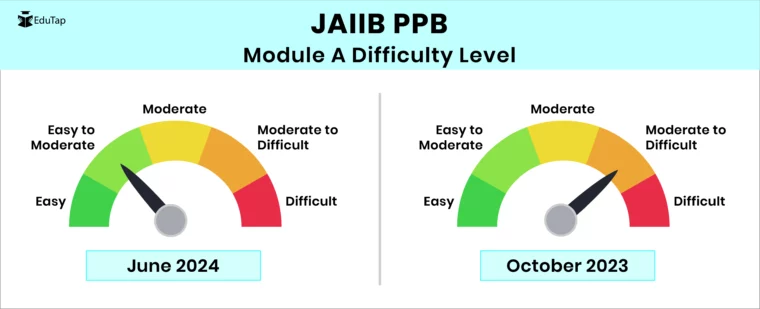

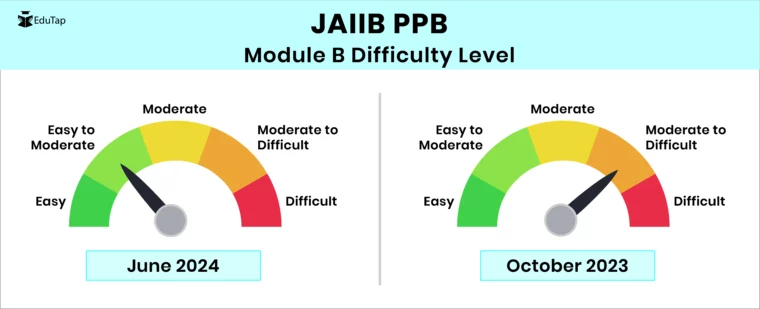

Now let’s look at the module-wise difficulty level of the PPB paper of June 2024.

JAIIB PPB June 2024: Module-Wise Difficulty Level

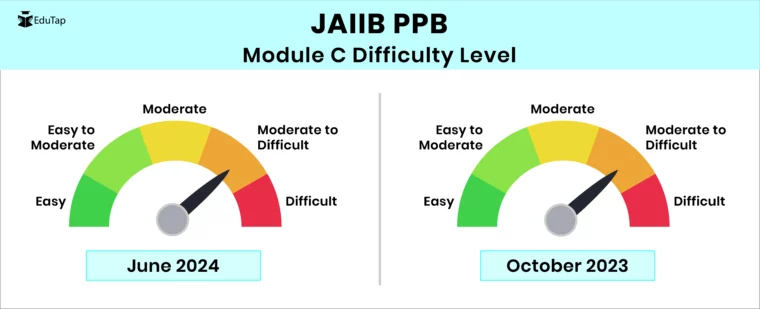

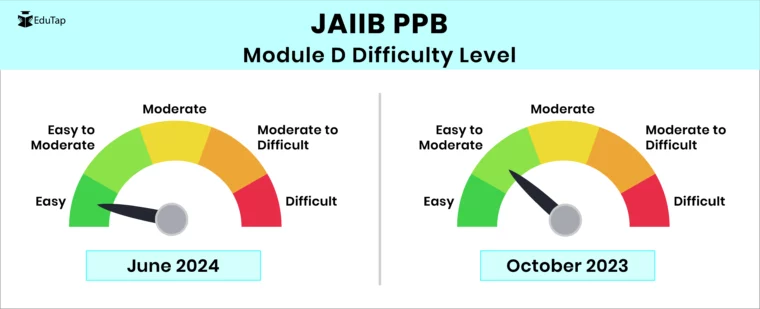

Here is the module-wise difficulty level of the JAIIB PPB paper held in June 2024 and it’s comparison with the October 2023 paper.

| Principles and Practices of Banking (PPB) | ||

| Module | June 2024 | October 2023 |

| A | Easy to Moderate | Moderate to Difficult |

| B | Easy to Moderate | Moderate to Difficult |

| C | Moderate to Difficult | Moderate to Difficult |

| D | Easy | Easy to Moderate |

Key Observations – Although Modules A and B were of moderate difficulty level, they account for a significant portion of the questions and should therefore be prioritized due to their high weightage.

Modules C and D, have less weightage, therefore they should be covered selectively to ensure essential concepts are covered.

After understanding the module-wise difficulty level of the JAIIB PPB June 2024 and October 2023 papers, let’s understand the module wise distribution of questions.

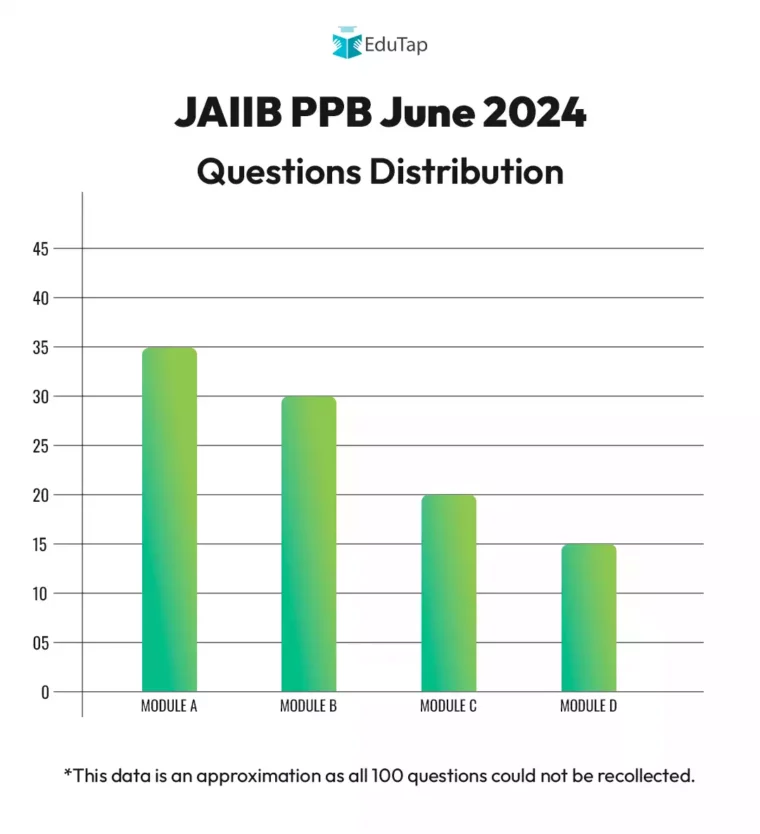

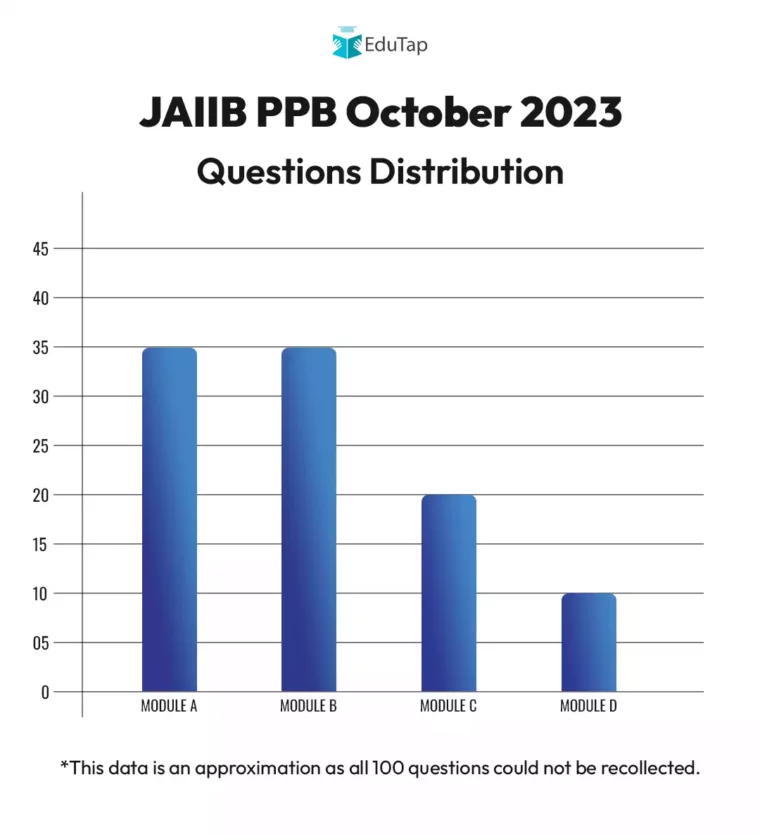

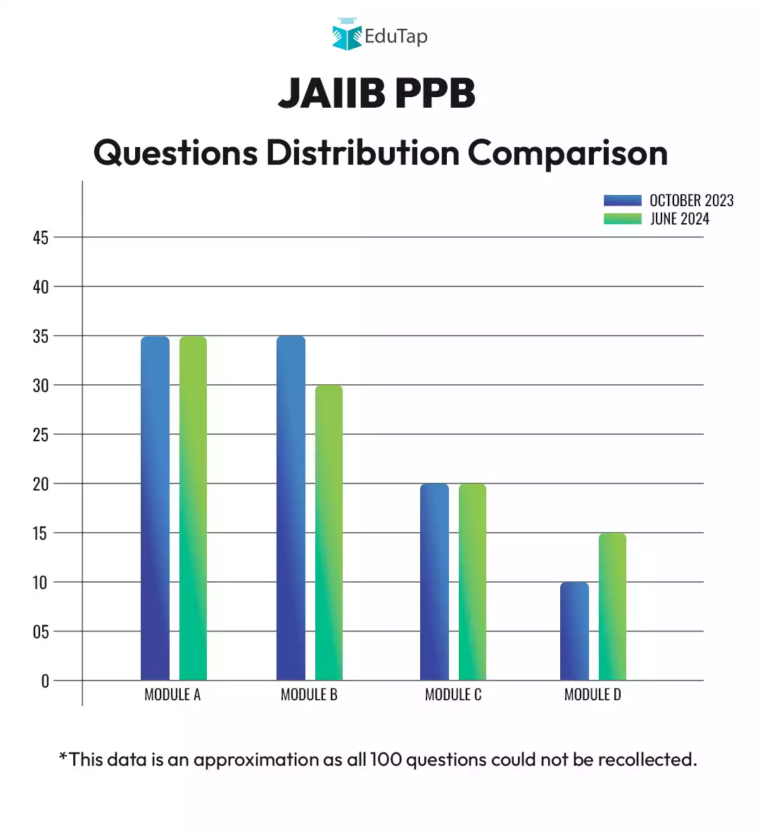

JAIIB PPB June 2024: Module-Wise Distribution of Questions

Here is the module-wise distribution of questions of the JAIIB PPB paper held in June 2024 and October 2023.

| Principles and Practices of Banking (PPB) | ||

| Module | June 2024 | October 2023 |

| A | 35 | 35 |

| B | 30 | 35 |

| C | 20 | 20 |

| D | 15 | 10 |

Note: Since all 100 questions could not be recollected, the above data is an approximation.

Now let’s look at the topic-wise distribution of questions.

JAIIB PPB June 2024: Topic-Wise Distribution of Questions

Here is the topic wise distribution of questions asked in the JAIIB PPB paper held in June 2024. We have also compared the number of questions asked in June 2024 with October 2023.

Module A

Topic | Number of Questions | |

| June 2024 | October 2023 | |

| Banker Customer Relationship | 3 | 4 |

| Organisational Set-up for AML | 3 | 3 |

| Money Laundering & Financing of Terrorism Risks | 1 | 1 |

| Accounts of Other Customers | 3 | NA |

| Legal Entity Identifier | 1 | NA |

| Wire Transfer | NA | 1 |

| Inoperative A/Cs & Unclaimed Deposits | 1 | NA |

| Salient Features of Deposit Accounts | 1 | 2 |

| Security Measures at Branches & ATMs | 1 | 1 |

| Cheque Truncation System | NA | 1 |

| Banker’s Lien | 1 | NA |

| Right of Appropriation | NA | 1 |

| Outward Remittances | 1 | 1 |

| Inward Remittance | NA | 1 |

| Permitted A/Cs in India for NRIs & PIOs | 1 | 2 |

| Cash Management | NA | 1 |

| Negotiable Instruments | 2 | 4 |

| Safe Deposit Lockers | 1 | 3 |

| Demand Draft | 2 | 1 |

| Garnishee Order | 1 | NA |

| Portfolio Management Services | NA | 1 |

| Financial Inclusion | NA | 1 |

| Grievance Redressal & RBI-IOS | NA | 3 |

| Consumer Protection Act | NA | 1 |

| RTI | NA | 1 |

Module B

| Topic | June 2024 | October 2023 |

| Types of Borrowers | 1 | 3 |

| Types of Credit Facilities | NA | 2 |

| Assessment of Working Capital | 4 | 1 |

| Assessment of Term Loans | 1 | NA |

| Operational Aspects of Common Loan Products | 1 | NA |

| Credit Monitoring | 2 | 2 |

| Types of Securities | 1 | NA |

| Advance Against Life Insurance Policy | 1 | NA |

| Types of Charges | 2 | 1 |

| Loan Against Term Deposit | 1 | NA |

| Essentials of a Contract | 2 | 1 |

| Contract of Guarantee | NA | 1 |

| Debt Recovery Tribunal | NA | 2 |

| Insolvency & Bankruptcy Code,2016 | 1 | NA |

| Legal Services Authority Act, 1987 | NA | 1 |

| Letter of Credit | 1 | 2 |

| Bill Finance | NA | 1 |

| Documentation | NA | 1 |

| Priority Sector Lending | NA | 1 |

| Agricultural Finance | NA | 2 |

| TReDS | NA | 1 |

| Bank Finance to NBFCs | NA | 1 |

| Government Sponsored Schemes | NA | 2 |

Module C

| Topic | June 2024 | October 2023 |

| Bank Computerisation | NA | 1 |

| Networking Technologies in Bank | 1 | 5 |

| Role & Uses of Technology Upgradation | NA | 1 |

| Core Banking Solutions | NA | 1 |

| Parameter/Master Files | NA | 1 |

| Control Mechanisms | NA | 1 |

| Electronic Banking | 1 | NA |

| Automated Teller Machine | 2 | 3 |

| Electromagnetic Card | 1 | 2 |

| Data Communication Networks | 3 | NA |

| Automated Clearing System | 1 | NA |

| Emergence of Electronic Payment System in India | 1 | NA |

| Electronic Clearing Systems in India | 1 | NA |

| National Payment Corporation of India | 3 | 2 |

| Emerging Technology Trends in Banking | 2 | 5 |

| Information System Security | 2 | 4 |

| Account Aggregators | NA | 1 |

| e-RUPI | 1 | NA |

| Data Warehousing & Mining | NA | 1 |

Module D

| Topic | June 2024 | October 2023 |

| Ethics & Business Values | 1 | 1 |

| Ethical Foundation of Banking | 1 | 1 |

| Ethics in the Indian Context | 1 | 1 |

| Ethical Foundation of Being Professional | 1 | 1 |

| Global Financial Crisis | 1 | NA |

| Values | 1 | NA |

| Personal Ethics & Business Ethics | 1 | NA |

| Ethical Dilemmas | 1 | NA |

| Managing Conflict of Interest | 1 | 1 |

| Ethics of Information Security | NA | 1 |

Important Note: The above data is derived from 69 recollected memory-based questions of the JAIIB PPB June 2024 paper and 93 of the JAIIB PPB October 2023 paper. Since all 100 questions could not be recollected, we have used NA to indicate where data is insufficient.

Key Observation: Although topics such as Banker Customer Relationship, Organizational Set-up for AML, Accounts of Other Customers, and Types of Credit Facilities are frequently repeated in the exam, questions are sourced from all topics in the syllabus. Aspirants should emphasize on these repeated topics while ensuring that they do not deprioritize other topics, especially those from Modules A and B.

After understanding the detailed analysis of the JAIIB PPB June 2024 paper and it’s comparison with the October 2023 paper, let’s find the key takeaways.

Key Takeaways

Here are the key takeaways for you to prepare smartly for the PPB paper

1. Study Sources

- The best source to prepare for PPB is the IIBF-PPB book published by Macmillan Education, as almost 90% of the questions are derived from this book. However, since these books are lengthy and complex, it is advisable to start your preparation early. Additionally, the data provided in the books might be outdated and may require updates to reflect the latest modifications. So, students should keep note of the latest updates.

- If using books as the main source of preparation, it is essential to cover the summaries and MCQs given at the end of each chapter for all chapters, regardless of the module and chapter importance.

2. Important Topics

Based on the above analysis, here is the list of module-wise important topics for the JAIIB PPB paper.

Module A

- Requirements to be Called a Bank

- Money Laundering

- Accounts of Other Customers

- Inoperative Accounts & Unclaimed Deposits

- Salient Features of Deposit Accounts

- Security Measures at Branches & ATMs

- Banker’s Lien

- Outward Remittances

- Permitted A/Cs in India for NRIs & PIOs

- Safe Deposit Lockers

- Demand Draft

- Garnishee Order

Module B

- Types of Borrowers

- Assessment of Working Capital and Term Loans

- Credit Monitoring

- Types of Securities

- Advance Against Life Insurance Policy

- Types of Charges

- Loan Against Term Deposit

- Essentials of a Contract

- Insolvency & Bankruptcy Code,2016

- Contract Consideration

Module C

- Networking Technologies in Bank

- Electronic Banking

- Automated Teller Machine

- Data Communication Networks

- Automated Clearing System

- Emergence of Electronic Payment System in India

- Electronic Clearing Systems in India

- National Payment Corporation of India

- Emerging Technology Trends in Banking

- Information System Security

Module D

- Ethics & Business Values

- Ethical Foundation of Banking

- Ethics in Indian Context

- Ethical Foundation of Being Professional

- Personal Ethics & Business Ethics

- Ethical Dilemmas

- Managing Conflict of Interest

3. Important Modules

The order of importance of modules is as follows:

- Modules A and B are most important and are to be prepared on priority as 65-70% of questions are asked from these 2 modules. The changing difficulty levels should not impact the priority of these modules.

- Modules C and D are comparatively less important. However, if time permits, preparing for these modules can be beneficial as the questions from these modules are relatively easy. In scenarios where questions from Modules A and B are difficult, Modules C and D can help immensely in clearing the cut-off.

- While some topics are frequently asked, the exam questions are sourced from the entire syllabus. Aspirants should focus on key topics, but other topics should not be neglected, especially from Modules A and B.

- Shifting difficulty levels should not affect the student’s focus for the PPB JAIIB exam, as the extensive syllabus makes it difficult to cover everything in detail. Typically, the exam ranges from moderate to difficult, and even a supposedly easier paper can seem challenging due to its length.

4. Strategy & Tips

Here are the tips to help you prepare faster for the JAIIB PPB exam:

- Aspirants with less time can opt for crash courses and relevant MCQ series. In either method of preparation, tests should be given from time to time to revise and get an idea of the level of preparation.

- As often seen, this time also previous year’s MCQs are repeated. Referring to PYQs can be beneficial for preparation.

- The June 2024 exam level was moderate, but over the past few years, the difficulty level has increased, especially after syllabus updates. Hence, it is advisable to avoid last-minute preparation and start studying well in advance.

Conclusion

We have provided a detailed analysis of the JAIIB PPB paper and listed the important topics, overall/module-wise difficulty level and more. This knowledge can empower you to refine your preparation strategy, irrespective of whether you are a first-time aspirant or have taken the JAIIB exam before.

Frequently Asked Questions (FAQs)

The primary resource is the official IIBF-PPB book published by Macmillan Education, and 90% of the questions asked are from this book. However, these books are bulky, and for quicker preparation, consider Crash Courses and Test Series.

Prioritize Modules A and B first, as these typically comprise 70% of the questions. Keep the Modules C and D for the end.

It is crucial to prioritize the important modules in your preparation, but neglecting other modules is not advisable. Even in time constraints, it is recommended to cover the basics of the less significant modules rather than leaving them entirely.