For ambitious individuals navigating the dynamic Indian banking sector, the JAIIB (Junior Associate of the Indian Institute of the Bankers) and CAIIB (Certified Associate of the Indian Institute of Bankers) exams hold the key to unlocking doors of opportunity and success.

These certifications, offered by the Indian Institute of Banking and Finance (IIBF), are more than just academic awards; they are stepping stones to financial rewards, career advancement, and personal growth.

In this article, we’ll explain the benefits of clearing the JAIIB and CAIIB exams in detail, allowing aspirants like you to make informed decisions about their banking careers. But before jumping on the benefits, let’s understand who is eligible for these exams.

Who is Eligible to Give JAIIB and CAIIB?

Individuals employed in organizations that are institutional members of IIBF are eligible to take the JAIIB and CAIIB exams, regardless of their current roles. It’s important to note that public sector banks, private sector banks, cooperative banks, regional rural banks, and non-banking financial companies (NBFCs) are members of IIBF.

However, there are some exceptions, such as ICICI, which is not a member of IIBF, making individuals working there ineligible for JAIIB and CAIIB. Additionally, some IT companies diversifying into the financial services sector, like TCS, are members of IIBF.

Now that you have understood the eligibility of taking the JAIIB and CAIIB exams, let’s understand the benefits you’ll get after passing these exams.

Financial Benefits

Here are the financial benefits you’ll get after qualifying the JAIIB and CAIIB exams:

1. Salary Increment

In public sector banks, qualifying the JAIIB exam earns you one salary increment on your basic pay. Moreover, upon passing the CAIIB exam, officers are entitled to receive an additional increment, while clerical or supervisory staff become eligible for two increments.

In total, clerical or supervisory staff can receive three increments, and officers can receive two increments by successfully qualifying both the JAIIB and CAIIB exams.

Old-generation private sector banks (e.g., Federal Bank, Karnataka Bank) affiliated with IIBF adhere to salary increment benefits similar to public sector banks. However, modern private sector banks (e.g., HDFC Bank, Yes Bank) tie increments to performance. Therefore, clearing JAIIB and CAIIB in these banks can lead to added responsibilities, resulting in potential increments based on your achievements. The same is also true for NBFCs.

2. Allowance Increment

As your basic pay rises, the augmentation in other allowances, such as Travel Allowance (TA), Dearness Allowance (DA), and House Rent Allowance (HRA) occurs simultaneously. This leads to a comprehensive enhancement in your overall compensation package.

3. Increase in Pension Corpus

With the rise in your income, there is a corresponding increase in your contribution to the pension corpus.

After getting familiar with the financial benefits, let’s understand how JAIIB and CAIIB certifications can help you progress your career to new heights.

Career Growth

Below, we have explained how you can achieve remarkable career growth after qualifying the JAIIB and CAIIB exams:

4. Higher Promotion Chances

Possessing JAIIB and CAIIB certifications gives you a significant edge in internal promotions. Banks actively seek qualified individuals for crucial positions, and these certifications demonstrate your commitment to professional development.

5. Access to Specialized Roles

Successfully clearing JAIIB and CAIIB opens doors to specialized departments within the banking sector. Departments such as Treasury, Forex, and Risk Management seek individuals with advanced qualifications, providing opportunities for career growth. These roles often come with higher salaries, making them attractive avenues for professionals aiming to elevate their careers in banking.

6. Internal Mobility

Qualifying JAIIB and CAIIB exams increases your chances of transferring to desired departments, diversifying your experience and career satisfaction.

After getting familiar with the career growth opportunities, let’s understand how JAIIB and CAIIB certifications can help you increase your expertise.

Knowledge and Skills Enhancement

Here is how clearing JAIIB and CAIIB exams can help you increase your knowledge and skills.

7. Knowledge Upgradation

The JAIIB and CAIIB certifications provide comprehensive knowledge about banking operations, finance, technology, and related domains. This enhances your expertise and makes you a more valuable asset to your organization.

8. Better Decision-Making Skills

The enhanced knowledge gained through these certifications translates to better decision-making abilities in your daily work, boosting your confidence and competence.

After understanding how qualifying JAIIB and CAIIB exams can help you increase your knowledge and expertise, let’s take a look at how these certifications can help you grow personally.

Personal Growth

Here is how qualifying JAIIB and CAIIB exams helps you grow personally.

9. Boosted Self-Respect

Successfully qualifying JAIIB and CAIIB exams strengthens your self-belief and provides a sense of accomplishment, contributing to positive personal growth.

10. Increased Confidence

Tackling these exams head-on boosts your confidence in your abilities, preparing you to seize any opportunity that comes your way.

After getting familiar with how JAIIB and CAIIB certification can help you grow as a person, let’s understand some other benefits of qualifying the exam.

Additional Benefits

Here are some additional benefits of qualifying JAIIB and CAIIB examinations.

11. Increased Status and Recognition

Clearing JAIIB and CAIIB exams not only gains peers’ respect but also establishes your recognition within the banking sector.

12. Job Security

Qualifying these exams makes you a valued asset, potentially enhancing your job security in a competitive market.

Benefits of Qualifying JAIIB Exam

Below, we have mentioned the benefits of qualifying the JAIIB exam.

13. Eligibility for CAIIB

Candidates who have successfully cleared the JAIIB exam become eligible to appear for the CAIIB exam.

Now that you have understood the benefits of passing the JAIIB and CAIIB exams, let’s find out the benefits of qualifying them in your first attempt.

Benefits of Clearing the JAIIB and CAIIB Exam in Your First Attempt

Clearing the JAIIB and CAIIB exam in your first attempt offers several benefits that go beyond simply passing the exam. Read below:

1. Time and Resource Optimization

Ditch the stress of repeat attempts by qualifying the JAIIB and CAIIB exams in your first attempt to save your valuable time and resources. No more registration fees, re-buying study materials, or dedicating additional preparation periods.

2. Early Access to Financial Rewards

Reap the financial benefits sooner. Clearing the exams unlocks instant access to salary increments, accelerating your financial growth and paving the way for a brighter future.

3. Future-Proofing Against Potential Shifts

In 2023, IIBF changed the JAIIB and CAIIB syllabus to make these exams more competitive. There is a chance that IIBF can introduce a negative marking scheme in the upcoming years.

While educated guesses could previously offer some benefit, the potential introduction of negative marking in JAIIB and CAIIB exams would eliminate that strategy entirely. This shift could undoubtedly increase the overall difficulty of qualifying these exams.

Now that you have understood the benefits of qualifying the JAIIB and CAIIB exams in your first attempt, let’s understand how to prepare for these exams.

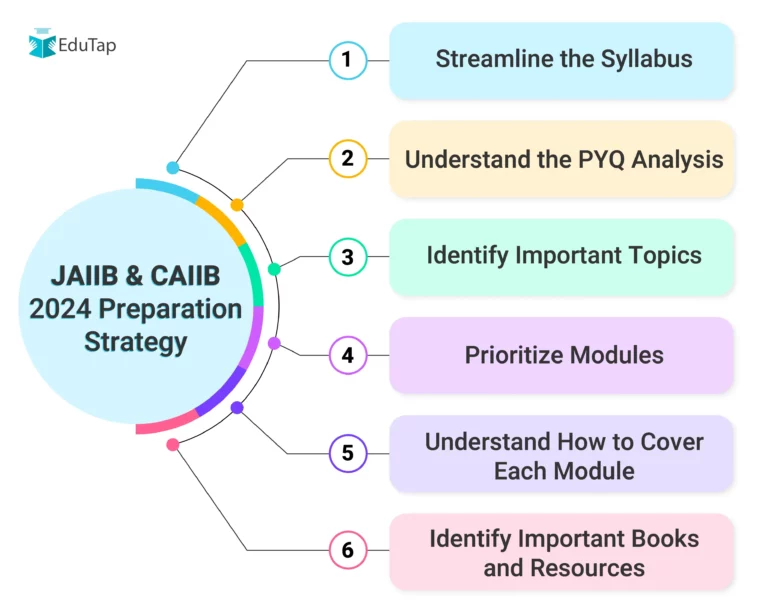

JAIIB and CAIIB 2024 Preparation Strategy

Here are the 7 easy steps that can help you prepare for the JAIIB and CAIIB exams and qualify them in your first attempt.

Step 1: Streamline the Syllabus

Streamlining the JAIIB and CAIIB syllabus is crucial as these exams are qualifying in nature and do not require 100% marks. Streamlining the syllabus allows you to identify the key concepts and areas of focus more clearly, preventing you from feeling overwhelmed by the vastness of the exam syllabus. This allows you to concentrate your studies on the most important topics, maximizing your time and effort.

Step 2: Understand the PYQ Analysis

PYQ analysis reveals which topics appear regularly in the paper, their weightage, and question types, allowing you to prioritize your study efforts and focus on areas with high weightage.

Step 3: Identify Important Topics

By analyzing the PYQs, you can understand past trends and identify the most important topics for each subject. To make it easy for you, we have analyzed the PYQs. Click here to get the most important topics of JAIIB.

Step 4: Prioritize Modules

After identifying important topics for each subject of the JAIIB and CAIIB exams, you should prioritize which module to start first. It will help you allocate more time to crucial topics that carry higher weightage in the paper.

Step 5: Understand How to Cover Each Module

Start with covering important topics from each module by dividing them into manageable chunks and setting realistic deadlines for completion. After covering important topics, start practicing PYQs and mock tests. Analyze your performance to identify your strengths and weaknesses and work on refining your weak areas while maintaining and enhancing your strengths.

Step 6: Identify Important Books and Resources

Here are the best books and sources to prepare for JAIIB and CAIIB exam:

| Best Books for JAIIB Preparation | ||||

| Subject | Books | Author | Publisher | Buy Here |

| Indian Economy and Indian Financial System (IEIFS) | NCERT Economy Books for Class XI & XII | NCERT | NCERT | Buy Online |

| Indian Economy & Indian Financial System | IIBF | Macmillan | Buy Online | |

| Principles and Practices of Banking (PPB) | Principles & Practices of Banking | IIBF | Macmillan | Buy Online |

| Accounting & Financial Management for Bankers (AFM) | Class XI – Financial Accounting Part 1 | NCERT | NCERT | Buy Online |

| Class XI – Financial Accounting Part 2 | NCERT | NCERT | Buy Online | |

| Class XII – Company Accounts & Analysis of Financial Statements | NCERT | NCERT | Buy Online | |

| Accounting & Financial Management For Bankers | IIBF | Macmillan | Buy Online | |

| Retail Banking & Wealth Management (RBWM) | Retail Banking & Wealth Management | IIBF | Macmillan | Buy Online |

| Best Books for CAIIB Preparation | ||||

| CAIIB Compulsory Paper | ||||

| Subject | Books | Author | Publisher | Buy Here |

| Advanced Bank Management (ABM) | Advanced Bank Management | IIBF | Macmillan | Buy Online |

| Bank Financial Management (BFM) | Bank Financial Management | IIBF | Macmillan | Buy Online |

| Advanced Business & Financial Management (ABFM) | Advanced Business & Financial Management | IIBF | Macmillan | Buy Online |

| Banking Regulations and Business Laws (BRBL) | Banking Regulations and Business Laws | IIBF | Macmillan | Buy Online |

| CAIIB Elective Paper | ||||

| Rural Banking | Rural Banking | IIBF | Macmillan | Buy Online |

| Human Resources Management | Human Resources Management | IIBF | Macmillan | Buy Online |

| Information Technology & Digital Banking | Information Technology & Digital Banking | IIBF | Macmillan | Buy Online |

| Risk Management | Risk Management | IIBF | Macmillan | Buy Online |

| Central Banking | Central Banking | IIBF | Macmillan | Buy Online |

After familiarizing yourself with the recommended books, explore additional sources for comprehensive JAIIB and CAIIB preparation.

Other Recommended Resources

For more details, refer to the “Best Books for JAIIB Exam” article.

Now that you have understood how to prepare for the JAIIB and CAIIB exams, take a look at the study plan for the JAIIB preparation.

Study Plan For the JAIIB 2024 Preparation

Here’s a subject-wise sample study plan that you can customize according to your strengths, weaknesses, and the available time you have:

1. Indian Economy and Indian Financial System

Follow the below-mentioned strategy to prepare for the Indian Economy and Indian Financial System:

| Indian Economy and Indian Financial System | |||

| SNo. | Module | Time | Instructions |

| 1 | Module A: Indian Economic Architecture | 7 Hours |

|

| 2 | Module B: Economic Concepts Related To Banking | 5 Hours |

|

| 3 | Module C: Indian Financial Architecture | 6 Hours |

|

| 4 | Module D: Financial Products And Services | 12 Hours |

|

| Total | 30 Hours | ||

2. Principles and Practices of Banking

Follow the below-mentioned strategy to prepare for Principles and Practices of Banking:

| Principles and Practices of Banking | |||

| SNo. | Module | Time | Instructions |

| 1 | Module A: General Banking Operations | 15 Hours |

|

| 2 | Module B: Functions of Banks | 12 Hours |

|

| 3 | Module C: Banking Technology | 8 Hours |

|

| 4 | Module D: Ethics In Banks And Financial Institutions | 10 Hours |

|

| Total | 45 Hours | ||

3. Accounting and Financial Management for Bankers

Follow the below-mentioned strategy to prepare for Accounting and Financial Management for Bankers:

| Accounting and Financial Management for Bankers | |||

| SNo. | Module | Time | Instructions |

| 1 | Module A: Accounting Principles and Processes | 8 Hours |

|

| 2 | Module B: Financial Statement and Core Banking Systems | 7 Hours |

|

| 3 | Module C: Financial Management | 10 Hours |

|

| 4 | Module D: Taxation and Fundamental of Costing | 5 Hours |

|

| Total | 30 Hours | ||

4. Retail Banking and Wealth Management

Follow the below-mentioned strategy to prepare for Retail Banking and Wealth Management:

| Retail Banking and Wealth Management | |||

| SNo. | Module | Time | Instructions |

| 1 | Module A: Retail Banking | 4 Hours |

|

| 2 | Module B: Retail Products and Recovery | 8 Hours |

|

| 3 | Module C: Support Services – Marketing of Banking Services/Products | 5 Hours |

|

| 4 | Module D: Wealth Management | 10 Hours |

|

| Total | 22 Hours | ||

General Tips:

- Adjust the above timetable to suit your specific needs.

- Take short breaks (5-10 minutes) between sessions.

- Practice as many mock tests as possible and review your performance, identify your weak areas, and dedicate more time to them.

- Structure your study schedule to align with your daily routine. For working professionals, consider dedicating extended study periods on weekends to optimize exam preparation.

Conclusion

Clearing the JAIIB and CAIIB exams offers various benefits. These certifications unlock a vault of opportunity and ignite a personal transformation. They elevate your status within the banking industry, granting you instant recognition and respect. Moreover, you are eligible to receive financial benefits, propelling you towards financial independence. The knowledge gained strengthens your decision-making, empowering you to tackle complex challenges.

FAQs

There is no limit to the number of attempts for the JAIIB and CAIIB exams. As long as you fulfill the eligibility criteria, you can attempt the exam as many times as needed to pass.

Time management is crucial during the JAIIB and CAIIB exams. Allocate a specific time to each question and section, and move on if you get stuck on a particular question to ensure you complete the exam within the given time.

While promotions depend on various factors, passing these exams can significantly enhance your resume and make you an eligible candidate for senior positions. It can also shorten the time it takes to reach managerial roles.

The exact amount varies depending on your bank and position, but most banks offer salary increments and additional bonuses for JAIIB and CAIIB holders. Some banks even tie higher bonus payouts to these certifications.